2020/2021

Auto Insurance

Database Report

January 2024

The NAIC is the authoritative source for insurance industry information. Our expert solutions support the efforts

of regulators, insurers and researchers by providing detailed and comprehensive insurance information. The NAIC

offers a wide range of publications in the following categories:

Accounting & Reporting

Information about statutory accounting principles and

the procedures necessary for filing financial annual

statements and conducting risk-based capital

calculations.

Special Studies

Studies, reports, handbooks and regulatory research

conducted by NAIC members on a variety of insurance

related topics.

Consumer Information

Important answers to common questions about auto,

home, health and life insurance — as well as buyer’s

guides on annuities, long-term care insurance and

Medicare supplement plans.

Statistical Reports

Valuable and in-demand insurance industry-wide

statistical data for various lines of business, including

auto, home, health and life insurance.

Financial Regulation

Useful handbooks, compliance guides and reports on

financial analysis, company licensing, state audit

requirements and receiverships.

Supplementary Products

Guidance manuals, handbooks, surveys and research on

a wide variety of issues.

Legal

Comprehensive collection of NAIC model laws,

regulations and guidelines; state laws on insurance

topics; and other regulatory guidance on antifraud and

consumer privacy.

Capital Markets & Investment Analysis

Information regarding portfolio values and procedures

for complying with NAIC reporting requirements.

Market Regulation

Regulatory and industry guidance on market-related

issues, including antifraud, product filing requirements,

producer licensing and market analysis.

NAIC Activities

NAIC member directories, in-depth reporting of state

regulatory activities and official historical records of

NAIC national meetings and other activities.

White Papers

Relevant studies, guidance and NAIC policy positions on

a variety of insurance topics.

© 2024 National Association of Insurance Commissioners. All rights reserved.

ISBN: 978-1-64179-377-3

Printed in the United States of America

No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic or

mechanical, including photocopying, recording, or any storage or retrieval system, without written permission from the NAIC.

NAIC Executive Office

444 North Capitol Street, NW

Suite 700

Washington, DC 20001

202.471.3990

NAIC Central Office

1100 Walnut Street

Suite 1500

Kansas City, MO 64106

816.842.3600

NAIC Capital Markets

& Investment Analysis Office

One New York Plaza, Suite 4210

New York, NY 10004

212.398.9000

For more information about NAIC

publications, visit us at:

http://www.naic.org//prod_serv_home.htm

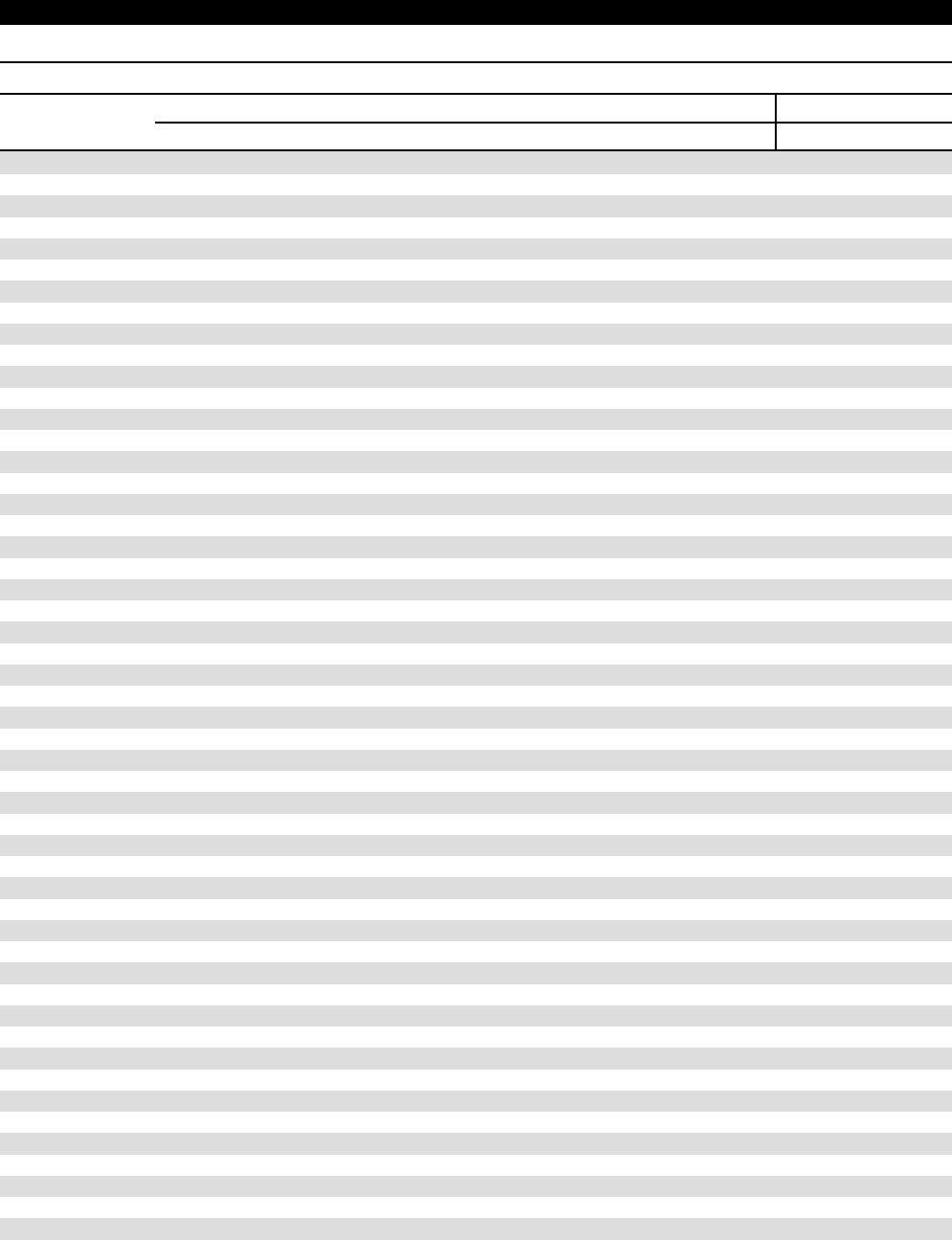

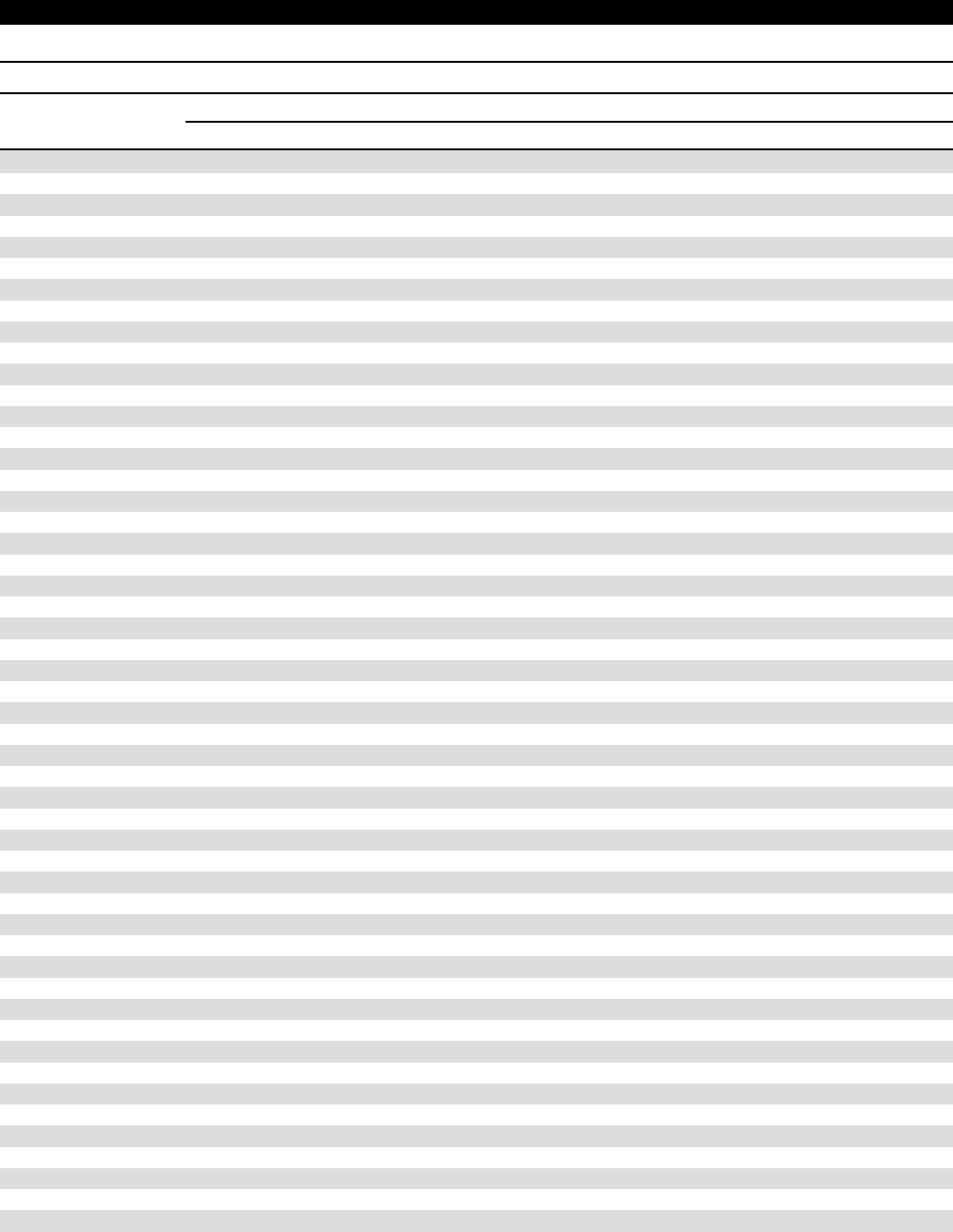

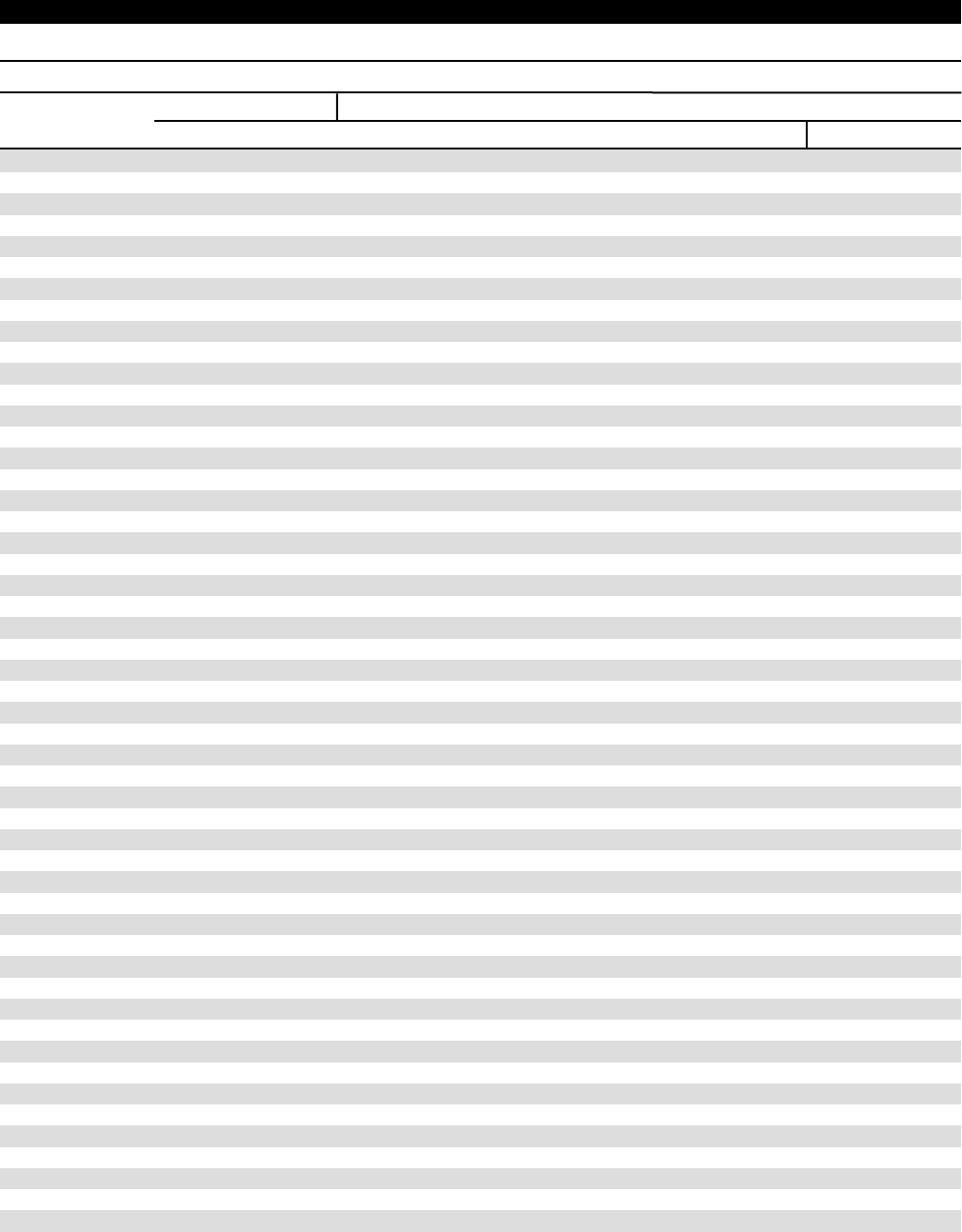

2020/2021 AUTO INSURANCE DATABASE

TABLE OF CONTENTS

INTRODUCTION 1

Introduction ................................................................................................................................................................. 1

Terms and Calculations ................................................................................................................................................ 2

AVERAGE PREMIUMS AND EXPENDITURES 4

Table 1.

Liability, 2017–2021 ........................................................................................................................ 15

Table 2.

Collision, 2017–2021 ...................................................................................................................... 18

Table 3.

Comprehensive, 2017–2021 ........................................................................................................... 21

Table 4.

Average Expenditure, 2017–2021 .................................................................................................. 24

Table 5.

Combined Average Premium, 2017–2021 ..................................................................................... 25

AUTO

INSURANCE

EARNED

AND

INCURRED

DATA

GENERAL

INFORMATION

26

Technical Notes .......................................................................................................................................................... 27

State-Specific Information .......................................................................................................................................... 29

BODILY

INJURY

LIABILITY

30

Table 6.

Bodily Injury Liability - Voluntary Business, 2018–2020 ................................................................. 33

Table 7.

Bodily Injury Liability - Residual Business, 2018–2020 ................................................................... 37

Table 8.

Bodily Injury Liability - Total Business, 2018–2020 ....................................................................... 41

PROPERTY

DAMAGE

LIABILITY

45

Table 9.

Property Damage Liability - Voluntary Business, 2018–2020 ......................................................... 47

Table 10.

Property Damage Liability - Residual Business, 2018–2020 ........................................................... 51

Table 11.

Property Damage Liability - Total Business, 2018–2020 ................................................................ 55

COMBINED

SINGLE

LIMITS

LIABILITY

59

Table 12.

Combined Single Limits Liability - Voluntary Business, 2018–2020 ............................................... 62

Table 13.

Combined Single Limits Liability - Residual Business, 2018–2020 ................................................. 70

© 2024 National Association of Insurance Commissioners

2020/2021 AUTO INSURANCE DATABASE

TABLE OF CONTENTS

Table 14.

Combined Single Limits Liability - Total Business, 2018–2020........................................................ 78

PERSONAL

INJURY

PROTECTION

86

Table 15.

Personal Injury Protection - Voluntary Business, 2018–2020 ......................................................... 89

Table 16.

Personal Injury Protection - Residual Business, 2018–2020 ........................................................... 93

Table 17.

Personal Injury Protection - Total Business, 2018–2020 ................................................................ 97

MEDICAL

PAYMENTS 101

Table 18.

Medical Payments - Voluntary Business, 2018–2020 ................................................................... 103

Table 19.

Medical Payments - Residual Business, 2018–2020 ..................................................................... 107

Table 20.

Medical Payments - Total Business, 2018–2020 .......................................................................... 111

UNINSURED/UNDERINSURED

MOTORIST 115

Table 21.

Uninsured/Underinsured Motorist - Voluntary Business, 2018–2020 ......................................... 118

Table 22.

Uninsured/Underinsured Motorist - Residual Business, 2018–2020 ............................................ 126

Table 23.

Uninsured/Underinsured Motorist - Total Business, 2018–2020 ................................................. 134

TOTAL LIABILITY

142

Table 24.

Total Liability - Voluntary Business, 2018–2020 ........................................................................... 144

Table 25.

Total Liability - Residual Business, 2018–2020 ............................................................................. 147

Table 26.

Total Liability - Total Business, 2018–2020 .................................................................................. 150

COLLISION 153

Table 27.

Collision - Voluntary Business, 2018–2020................................................................................... 155

Table 28.

Collision - Residual Business, 2018–2020 ..................................................................................... 159

Table 29.

Collision - Total Business, 2018–2020 .......................................................................................... 163

COMPREHENSIVE 167

Table 30.

Comprehensive - Voluntary Business, 2018–2020 ....................................................................... 169

© 2024 National Association of Insurance Commissioners

2020/2021 AUTO INSURANCE DATABASE

TABLE OF CONTENTS

Table 31.

Comprehensive - Residual Business, 2018–2020 ......................................................................... 173

Table 32.

Comprehensive - Total Business, 2018–2020 ............................................................................... 177

TRAFFIC

CONDITIONS

181

Table 33.

Fatal Accident Rates, 2018–2020 ................................................................................................. 183

Table 34.

Traffic Density, 2018–2020 ......................................................................................................... 184

CRIME 185

Table 35.

Vehicle Thefts, 2018–2020 .......................................................................................................... 187

ECONOMIC / DEMOGRAPHIC DATA 188

Table 36.

Population Densities, 2018–2020 ............................................................................................... 190

Table 37.

Disposable Income, 2018–2020 ................................................................................................... 191

STATE

LAWS

192

Table 38.

Rate Filing Laws, 2018–2020 and Current ..................................................................................... 210

Table 39.

Form Filing Laws, 2018–2020 and Current .................................................................................. 212

Table 40.

Tort Laws and Thresholds, 2018–2020 ........................................................................................ 214

Table 41.

Liability Insurance Laws, 2018–2020 ............................................................................................. 215

Table 42.

Personal Injury Protection and Uninsured Motorist Laws, 2018–2020 ........................................ 216

Table 43.

Automobile Seat Belt Laws, 2020 ................................................................................................ 217

Table 44.

Drunk Driving Laws and Speed Limits, 2020 ................................................................................ 218

Table 45.

Distracted Driving Laws, Current ................................................................................................. 219

APPENDIX 220

Appendix 1A.

Land Area and Population ........................................................................................................... 222

Appendix 1B.

Vehicles and Vehicle Thefts ......................................................................................................... 223

Appendix 1C.

Vehicle and Roadway Miles ......................................................................................................... 224

© 2024 National Association of Insurance Commissioners

INTRODUCTION

The cost of personal automobile insurance has

attracted considerable attention from regulators and

policymakers. To help the states assess their

particular insurance markets, the NAIC Property and

Casualty Insurance (C) Committee has directed the

Casualty Actuarial and Statistical (C) Task Force in

the development of this report. A database has been

compiled to make information about cost factors in

each state readily available to insurance regulators

monitoring the market, and to the public. The

database includes information related to insurance

markets, traffic conditions, medical costs, crime

rates, automobile repair costs, economic conditions,

and state laws related to automobile insurance.

The data used for this report include written

premiums and exposures for calendar years 2017-

2021 for the combined voluntary and residual

market. Earned and incurred data for

calendar/accident years 2018-2020 are also

reported, separately, for voluntary and residual

market business. Trends are derived from earned

premiums, earned exposures, incurred losses, and

incurred claims. Definitions of these terms can be

found on Page 2.

For each state, average premium and average

expenditure, pure premium, loss ratio, claim

frequency, and claim severity are calculated by

coverage. Auto insurance coverages included are

bodily injury and property damage liability (including

no-fault), uninsured and underinsured motorist

coverages, medical payments, collision, and

comprehensive.

Narratives at the beginning of each section provide

information about the type of coverage analyzed,

and define the calculations used for the tables in

that section. Any state-specific issues regarding the

coverage or data are also noted in the narratives.

The insurance data were obtained from the

following statistical agents: American Association of

Insurance Services (AAIS); Insurance Services Office

(ISO); National Independent Statistical Service (NISS);

Independent Statistical Service, Inc. (ISS),

Massachusetts Commonwealth Automobile

Reinsurers (M-CAR); and Maryland Auto Insurance

Fund (MAIF). Data were also obtained from the

California Department of Insurance and the Texas

Department of Insurance. The assistance of these

organizations in developing this report is greatly

appreciated. There may be data from other small

statistical agencies that are not included.

Data contained in this report may differ from data

contained in reports from previous years, as the

statistical agents periodically obtain updated

information from insurers.

The other sections of this report provide statistics for

each state on non-insurance characteristics that

would be expected to have some influence on the

cost of personal automobile insurance. In reviewing

these data and making interstate comparisons, it is

important to keep in mind that auto insurance

premiums ultimately reflect a complex set of state-

specific factors related to the insurers’ claims costs,

and that the data in this report by no means

represent all such factors.

The tables in this report were prepared under the

direction of the Casualty Actuarial and Statistical (C)

Task Force. Suggestions about how this database

might be further improved are welcome. Questions

may be referred to Justin Cox, Data Analyst II,

jcox7@naic.org.

Links to this report and other NAIC reports can be found

on the NAIC website at: NAIC Publications.

© 2024 National Association of Insurance Commissioners

1

Terms

and

Calculations

Below are definitions of terms and calculations used in this report. Formulas will vary depending on the

application, so readers should note the exact methods used in this report. For example, Average Premium may

be defined as Written Premiums / Written Exposures instead of Earned Premiums / Earned Exposures.

Terms

Premium: The dollar amount paid for an insurance

policy.

Exposure: A finite unit of risk related to a specific

insurance coverage. In this report, exposures are

expressed as car-years. One car-year is the risk

associated with insuring one car for one year.

Loss: The dollar amount associated with a claim.

Claim: A formal request for payment related to an

event or situation that is covered under an in-force

insurance policy.

Written Premiums: The total premium amount of

all policies issued during a given time period.

Written Exposures: The total number of exposures,

in car-years, of all policies issued during a given

time period.

Calendar Year: Earned premiums and loss

transactions occurring with the calendar year

beginning Jan. 1, irrespective of the contractual

dates of the policies to which the transactions

relate and regardless of the dates of the accidents.

Calendar/Accident Year: The accumulation of loss

data on all accidents with the date of occurrence

falling within a given calendar year. The earned

premium is the same as in calendar year.

Earned Premiums: The portion of the total

premium amount corresponding to the coverage

provided during a given time period.

Earned Exposures: The portion of the total amount

of exposure (risk) corresponding to the coverage

provided during a given time period.

Incurred Claims: The total number of claims

associated with insured events/situations occurring

during a given time period.

Incurred Losses: The total dollar amount of losses

associated with insured events/situations occurring

during a given time period. A portion of incurred

claims and losses represents insurers’ estimates of

the final costs of pending claims that are still open

during the reporting period, as well as estimates of

losses associated with claims that have yet to be

reported (termed Incurred But Not Reported, or

IBNR).

Voluntary Market: Consists of insurance consumers

that insurers select to be provided coverage, using

underwriting guidelines that are not unfairly

discriminatory. The voluntary market is also called

the normal or regular market.

Residual Market: Consists of insurance consumers

unable to obtain coverage in the voluntary market.

Example 1: An auto policy insuring two cars for six

months is issued on 9/28/2008, effective

10/1/2008. The cost of the policy is $600. The

policyholders decide to change insurers in early

2009 and cancel the policy effective 1/31/2009.

The written exposure for this policy is 2 cars × 1/2

year = 1 car-year and is included in calendar year

2008 exposures because the policy was issued in

2008. The written premium is $600 (cost of the

policy), and is included in calendar year 2008

premiums.

© 2024 National Association of Insurance Commissioners

2

The policy is in force for three months in 2008 and

for one month in 2009. For calendar year 2008, the

earned exposure is 2 cars × 1/4 year = 1/2 car-year,

and the earned premium is:

$600 × 1/2 policy length = $300.

The calendar year 2009 earned exposure is:

2 cars × 1/12 year = 1/6 car-year,

and the earned premium is:

$600 × 1/6 policy length = $100.

The remaining $200 of the original premium

amount is refunded to the policyholder and

counted as -$200 of written premium in calendar

year 2009.

Example 2: A two-vehicle auto accident occurs

11/23/2008. No one is hurt, but there is minor

damage to one car. The incident is reported as a

property damage liability claim to the appropriate

insurance company 11/27/2008. The cost of car

repairs is $537 and is paid by the insurer on

12/14/2008, minus a $250 deductible. Additional

damage from the accident is discovered five months

later, costing an additional $1,281, which the

insurer pays 6/3/2009.

There is one claim resulting from this accident,

which is included in accident year 2008 incurred

claims. Losses are $537 – $250 + $1,281 = $1,568

and are included in accident year 2008 incurred

losses. The discovery of additional damage is not a

separate claim because it results from the original

accident, so there is only one claim. The accident

occurs in 2008, so all associated losses are included

in accident year 2008 incurred losses, regardless of

when the losses are actually discovered, reported,

or paid.

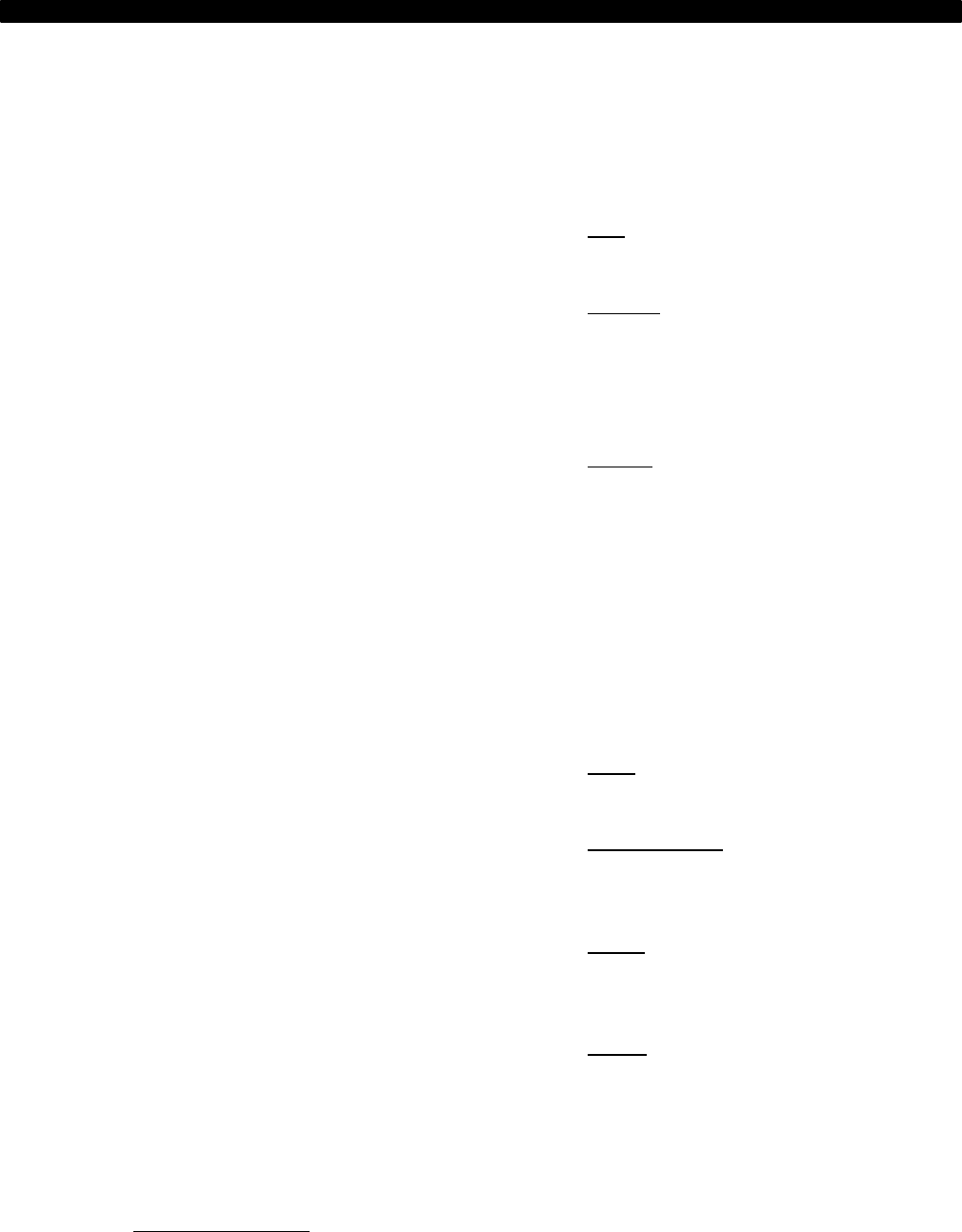

Formulas

Tables

1–5

Average Expenditure:

(Liability Written Premium +

Collision Written Premium +

Comprehensive Written Premium)

Liability Written Exposures

Combined Average Premium:

Liability Average Premium +

Collision Average Premium +

Comprehensive Average Premium

Liability Average Premium:

Liability Written Premiums

Liability Written Exposures

Collision Average Premium:

Collision Written Premiums

Collision Written Exposures

Comprehensive Average Premium:

Comprehensive Written Premiums

Comprehensive Written Exposures

Tables

6–35

Pure Premium:

Incurred Losses

Earned Exposures

Frequency:

Incurred Claims × 100

Earned Exposures

Loss Ratio:

Incurred Losses × 100

Earned Premiums

Severity:

Incurred Losses

Incurred Claims

© 2024 National Association of Insurance Commissioners

3

Average Premiums and Expenditures

© 2024 National Association of Insurance Commissioners

4

2017–2021 State Average Expenditures and

Average Premiums for Personal Automobile Insurance

Voluntary and Residual Market Business Combined

This section provides state average expenditures

and state average annual premium per insured

vehicle, for private passenger automobile insurance

for the years 2017–2021. These statistics measure

the relative cost of automobile insurance to

consumers in each state.

Results are included for bodily injury and property

damage liability (including no-fault), collision, and

comprehensive coverages—the basic components

of a personal auto insurance policy.

Average expenditure per insured vehicle is the total

written premium for liability, collision, and

comprehensive coverages divided by the liability

written car-years

1

(exposures). This assumes that all

insured vehicles carry liability coverage but do not

necessarily carry the physical damage coverages

(i.e., collision and/or comprehensive). The average

expenditure is an estimate of what consumers in

the state spent, on average, for auto insurance. In

2021, the countrywide average expenditure was

$1,062 an increase of 1.45% over the previous year.

The median state average expenditure was $926.

The state combined average premium per insured

vehicle, on the other hand, is calculated by

summing the average premiums for the three

coverages. The result is the average cost of an auto

insurance policy in the state that contains all three

coverages (i.e., liability, comprehensive, and collision).

The countrywide combined average premium increased

1.18% in 2021, to $1,189 over the prior year. The

median state combined average premium was $1,071.

Aggregate written premiums and aggregate written

exposures are used in calculations with no

distinction as to policyholder classifications, vehicle

characteristics, or the selection of specific limits or

deductibles, all of which significantly impact the

cost of coverage. Nor do the results consider

differences in state auto and tort laws, rate filing

laws, traffic conditions, or other demographics.

CAUTION: Because of these differences, direct

comparisons between state results should be

treated with a high degree of caution.

Tables 1A–1C show the states’ 2017–2021 written

premiums, written exposures, and average

premiums for liability insurance. Tables 2A–2C and

Tables 3A–3C show the same for collision and

comprehensive insurance, respectively. State

average expenditures are provided in Table 4, and

state combined average premiums are displayed in

Table 5.

1

A written car-year is equal to 365 days of insurance

coverage for a single vehicle and is the standard measure

of exposure for automobile insurance.

© 2024 National Association of Insurance Commissioners

5

Factors that Affect State Average Expenditures and

Average Premiums

Many factors affect the state-to-state differences in

average expenditures and premiums for automobile

insurance. Some important factors include:

•

Underwriting and loss adjustment expense

•

Types of coverages purchased

•

Relative amounts of coverages purchased

•

Use of telematics

•

Weather

•

Driving locations

•

Accident rates

•

Traffic density

•

Vehicle theft rates

•

Auto repair costs

•

Population density

•

Medical and legal costs

•

Per capita disposable income

•

Rate and form filing laws

•

Liability insurance requirements

•

Auto laws (seat belt, speed limits, etc.)

Insurance rates are developed based primarily on

the insurer’s cost of paying claims. Certain broad

characteristics of a state contribute to the

frequency and severity of auto claims and insurer

loss costs in that state. Many of these cost factors

can influence insurance prices, not only between

states, but also between communities and

neighborhoods—making price comparison between

states and within a state extremely complex.

It is reasonable to consider that the “general

economic conditions” in a state may affect the price

of auto insurance, but no direct measure of this

characteristic exists. There are measurable variables

that can be used as imperfect substitutes for these

general conditions to approximate their influence

on auto insurance price.

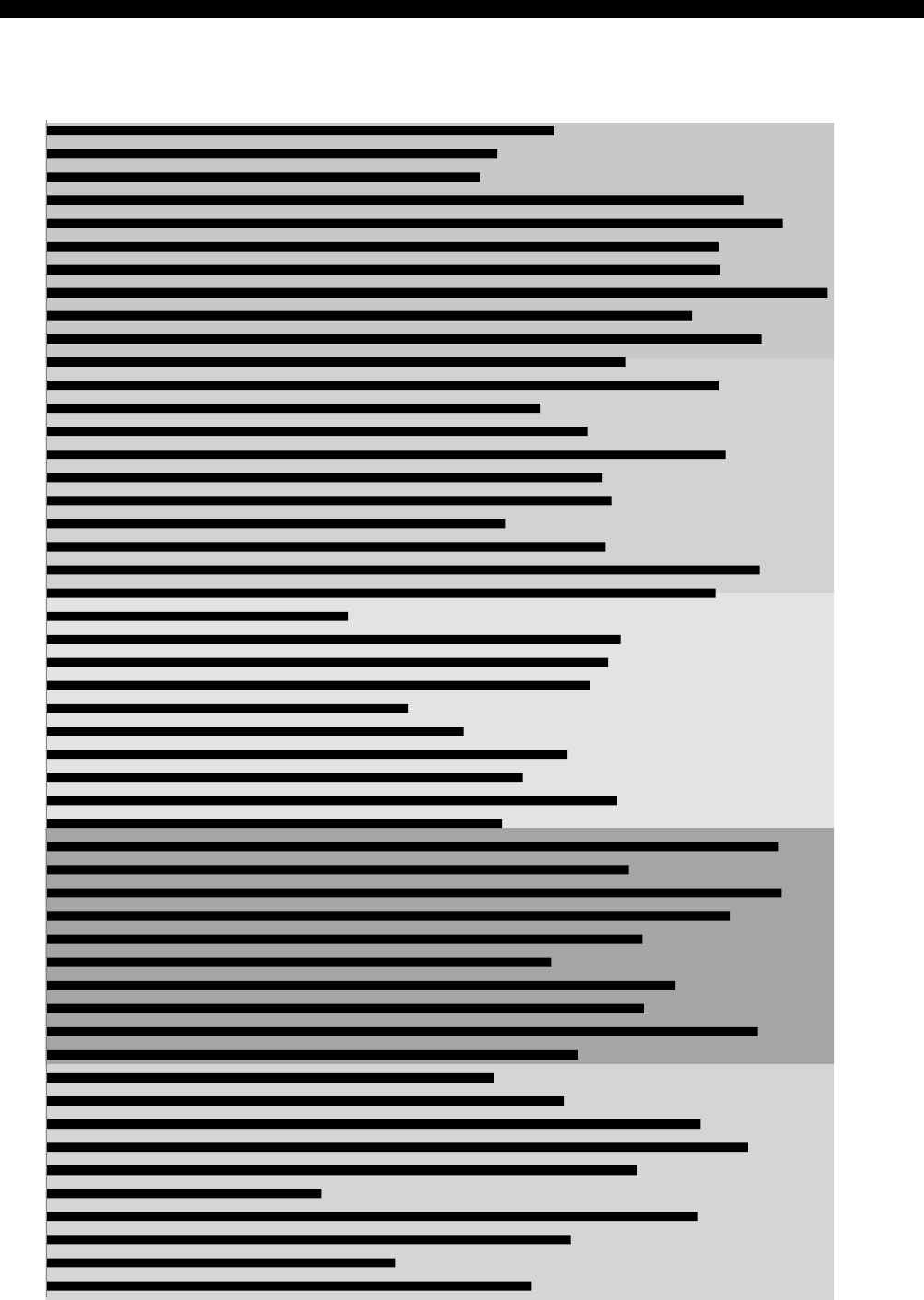

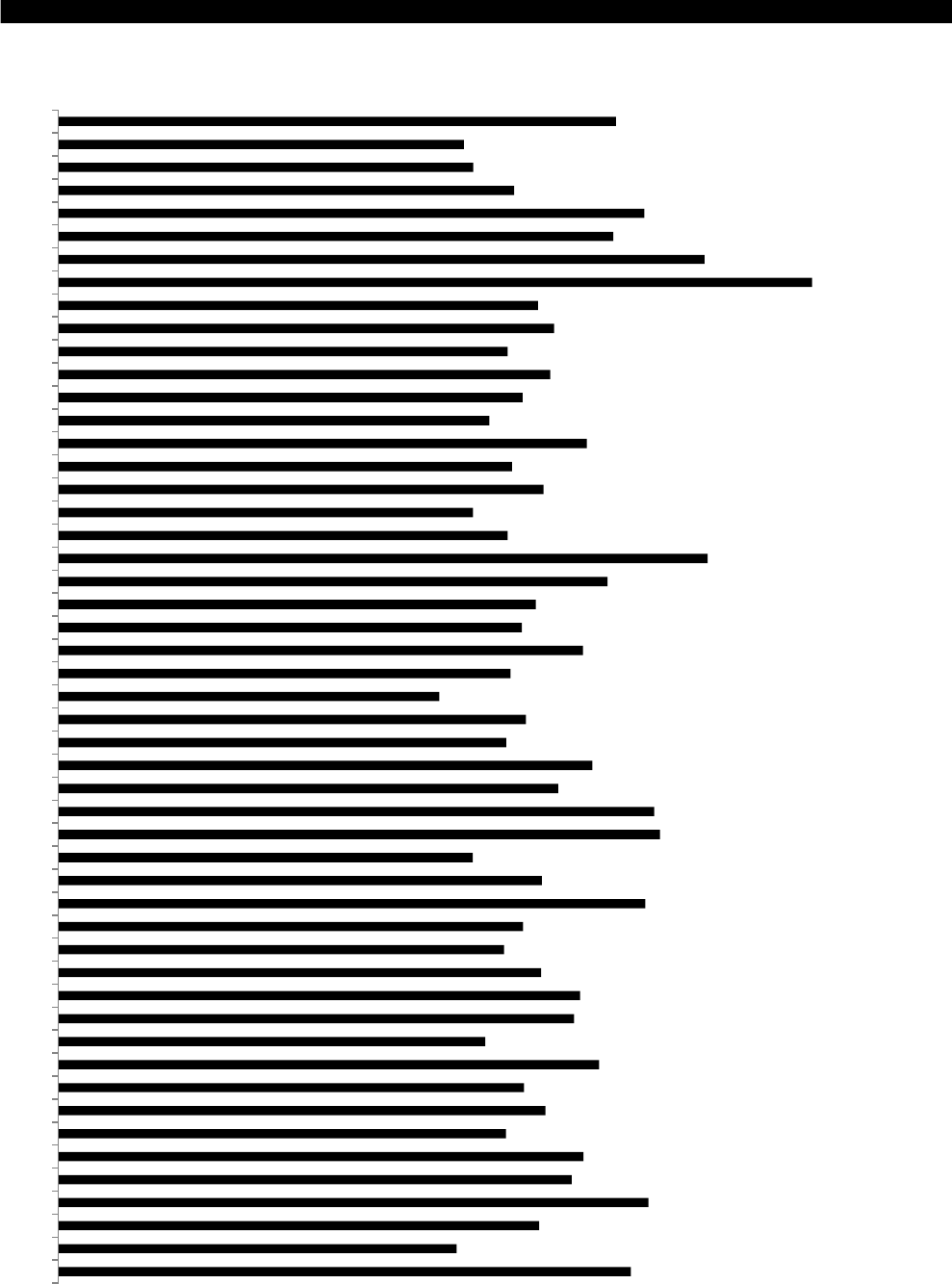

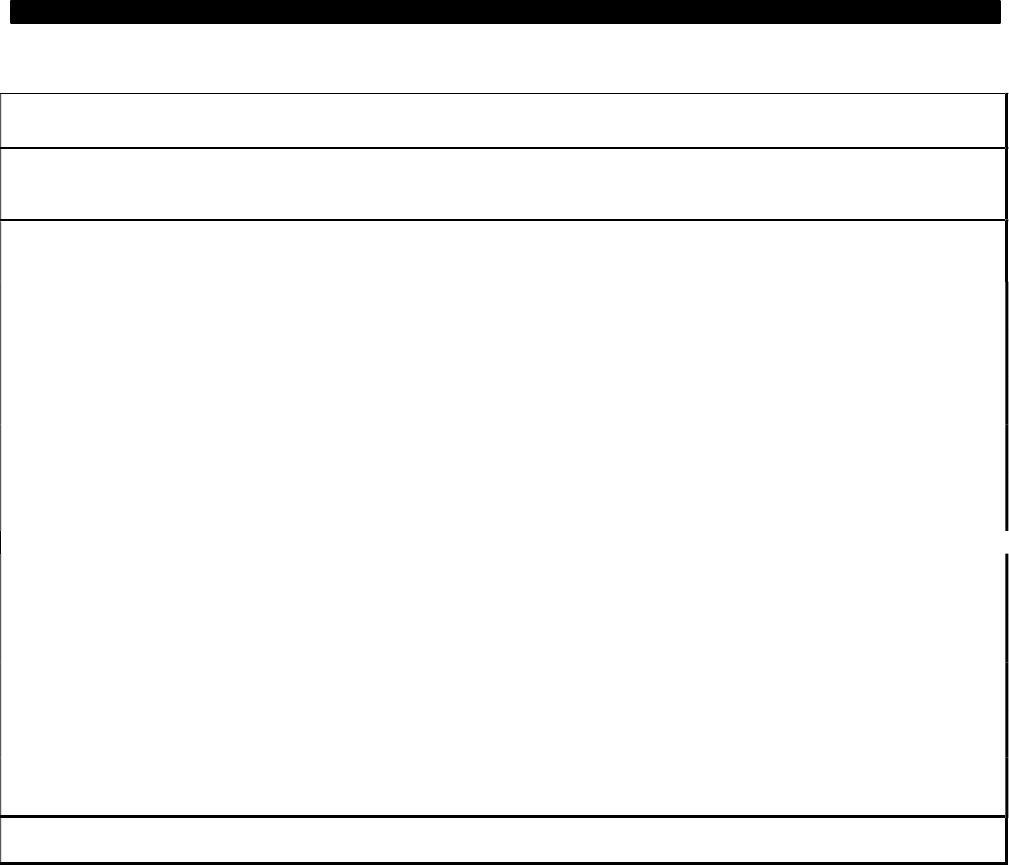

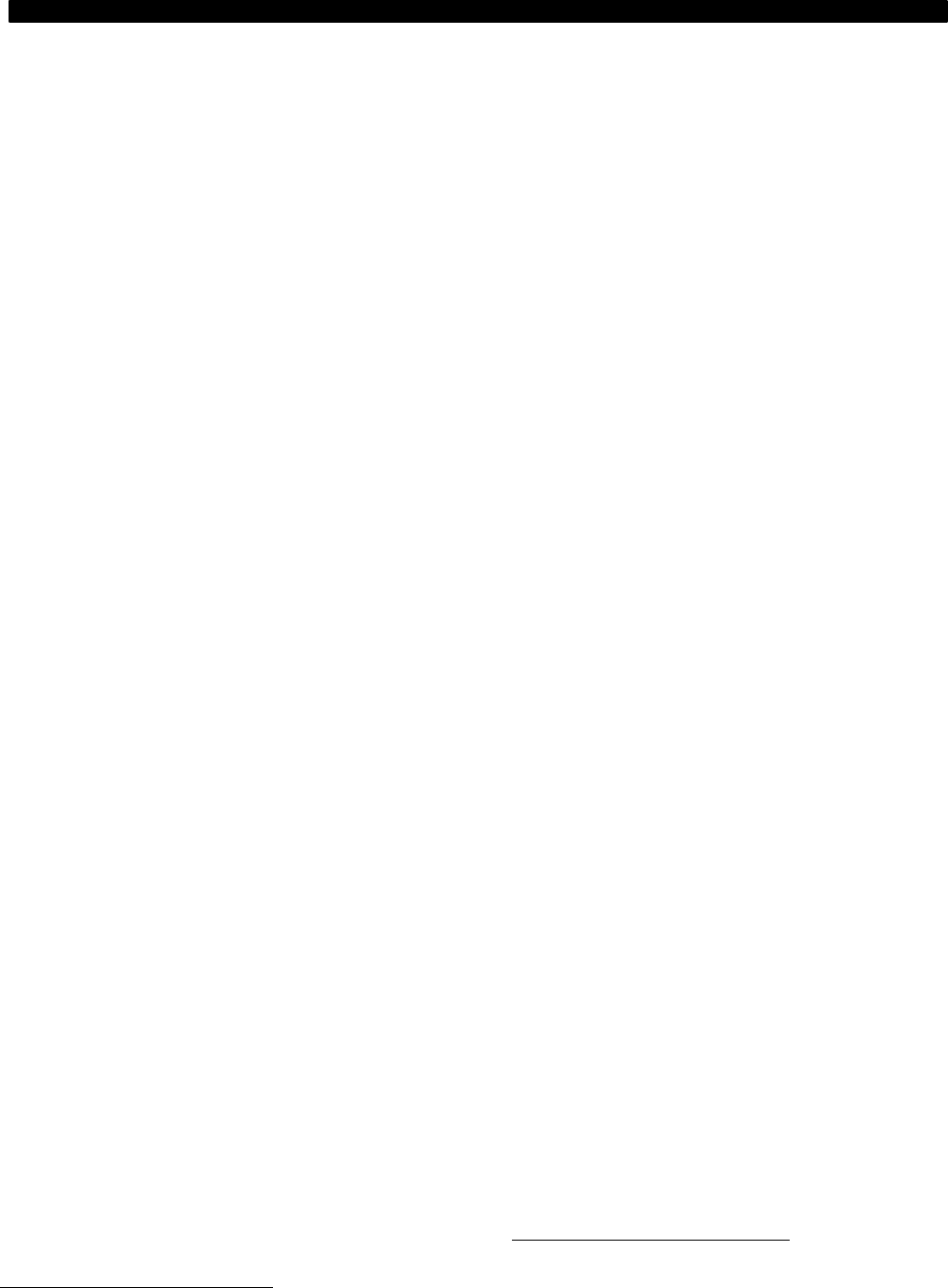

Three variables—urban population, miles driven per

number of highway miles, and disposable income

per capita—are correlated with the state auto

insurance premiums. Graphs on the following pages

show these variables for each state. The graphs

indicate that high-premium states tend to also be

highly urban, with higher wage and price levels, and

greater traffic density.

© 2024 National Association of Insurance Commissioners

6

Percentage of State Population Living in Urban Areas —

2020 U.S. Census

AK

AL

57.7%

AR

55.5%

AZ

CA

CO

CT

DC

DE

FL

GA

HI

IA

64.9%

63.2%

74.1%

89.3%

94.2%

86.0%

86.3%

82.6%

91.5%

86.1%

100.0%

ID

IL

IN

KS

KY

LA

MA

MD

ME

38.6%

MI

MN

MO

MS

MT

NC

ND

NE

46.3%

53.4%

58.7%

61.0%

69.2%

71.2%

72.3%

71.5%

73.5%

71.9%

69.5%

66.7%

73.0%

86.9%

91.3%

85.6%

NH

58.3%

NJ

NM

NV

NY

OH

OK

OR

PA

64.6%

74.5%

76.3%

80.5%

76.5%

87.4%

93.8%

94.1%

RI

SC

SD

TN

TX

UT

VA

VT

35.1%

WA

WI

WV

44.6%

57.2%

67.9%

66.2%

67.1%

75.6%

83.7%

83.4%

91.1%

89.8%

WY

62.0%

Source: U.S. Bureau of the Census

© 2024 National Association of Insurance Commissioners

7

Millions of Miles Driven per Mile of

Roadway 2020

AK

0.30

AL

AR

0.34

AZ

CA

CO

CT

DC

DE

FL

GA

HI

IA

0.26

ID

0.33

0.55

0.68

0.98

0.90

1.38

1.28

1.71

1.68

2.00

1.95

IL

IN

KS

0.20

KY

LA

MA

MD

ME

0.64

0.58

0.57

0.79

0.76

1.47

1.57

MI

MN

MO

MS

MT

0.16

NC

ND

0.10

NE

0.20

NH

NJ

NM

NV

NY

0.36

0.33

0.55

0.51

0.53

0.71

0.74

0.99

0.90

1.70

OH

OK

OR

PA

RI

SC

SD

0.12

0.36

0.41

0.73

0.68

0.84

1.14

TN

TX

UT

VA

VT

0.42

WA

WI

0.50

WV

0.41

WY

0.33

0.62

0.66

0.79

0.82

1.01

Source:

Federal

Highway

Administration,

20

21

Highway

Statistics

© 2024 National Association of Insurance Commissioners

8

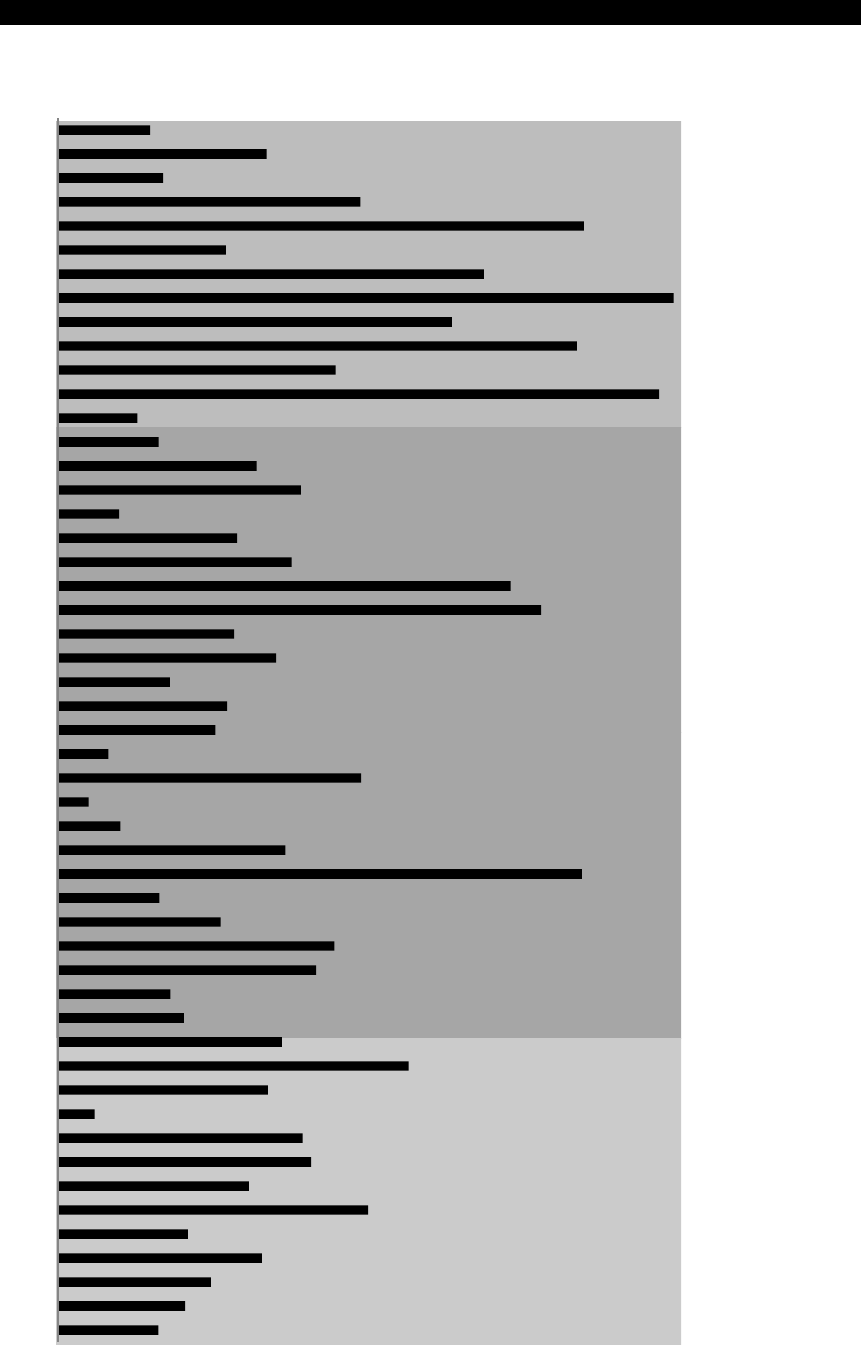

2020

Disposable

Income

Per

Capita

AK

AL

AR

AZ

CA

CO

CT

DC

DE

FL

GA

HI

IA

ID

IL

IN

KS

KY

LA

MA

MD

ME

MI

MN

MO

MS

MT

NC

ND

NE

NH

NJ

NM

NV

NY

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VA

VT

WA

WI

WV

WY

78,272

Source:

Bureau

of

Economic

Analysis

57,902

42,126

43,087

47,331

60,853

57,647

67,090

49,809

51,473

46,664

51,095

48,210

44,758

54,892

47,118

50,395

43,043

46,659

67,426

57,032

49,574

48,136

54,482

46,960

39,572

48,576

46,515

55,457

51,904

61,901

62,500

43,038

50,210

60,956

48,260

46,292

50,133

54,195

53,569

44,334

56,154

48,356

50,599

46,489

54,529

53,290

61,302

49,940

41,372

59,462

© 2024 National Association of Insurance Commissioners

9

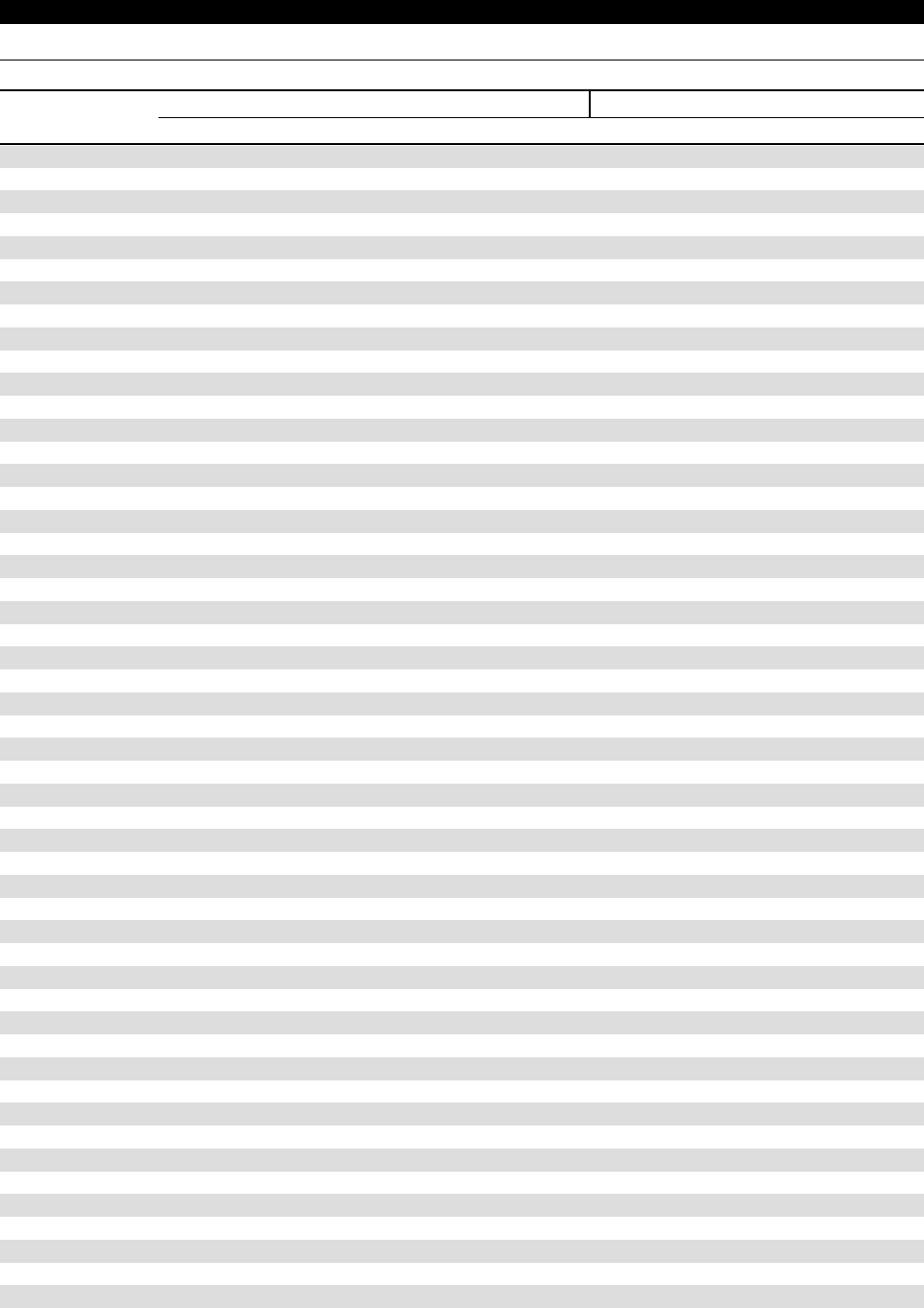

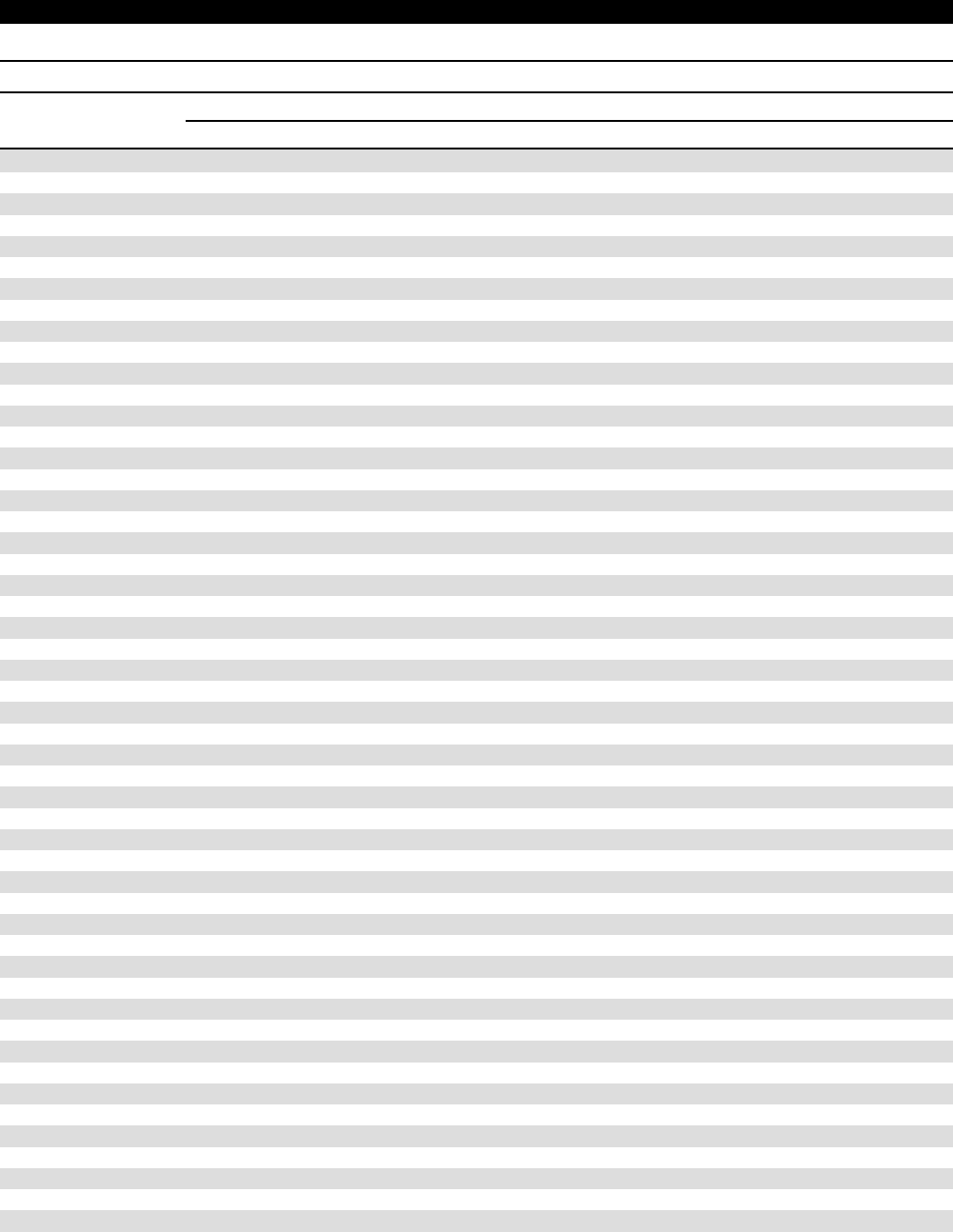

Annual Rates of Change in Consumer Price Indices, Average Expenditures, and Premiums

Annual Rates of Change in Consumer Price Indices, Average Expenditures and Premiums

2017

2018

2019

2020

2021

2017 - 2021

Cumulative 4-

Year Change

Consumer Price Index - All Items*

2.13%

2.00%

2.31%

1.32%

7.19%

13.35%

CPI - Auto Insurance*

8.15%

4.69%

0.10%

-4.76%

4.15%

3.95%

CPI - Total Medical Care*

1.77%

2.07%

4.62%

1.84%

2.23%

11.18%

CPI - Auto Maintenance and Repair*

1.84%

2.33%

3.42%

3.43%

4.78%

14.69%

CPI - Legal Service Fees*

1.32%

6.36%

-0.95%

1.30%

3.59%

10.55%

CPI - New Vehicles*

-0.65% -0.25%

0.05%

1.94%

11.81%

13.75%

CPI - Used Vehicles*

-0.96%

1.49%

-0.55%

10.35%

37.73%

53.40%

Average Expenditure**

6.68%

4.93%

1.29%

-2.37%

1.45%

5.27%

Combined Average Premium**

6.60%

4.83%

1.19%

-2.50%

1.18%

4.65%

Average Liability Premium**

7.24%

5.19%

0.97%

-3.15%

0.23%

3.10%

Average Collision Premium**

6.32%

4.01%

1.03%

-2.97%

1.82%

3.82%

Average Comprehensive Premium**

4.85%

5.33%

2.39%

1.04%

3.24%

12.50%

*

U.S. Bureau of Labor Statistics

** NAIC

The Consumer Price Index (CPI) for all items

measures the cost of a fixed set of consumer goods

and services purchased by a set population.

Similarly, the CPI for automobile insurance is an

index measuring the cost of automobile insurance

to consumers over time. The annual rate of change

in the average premium and average expenditure

will vary from the annual rate of change in the

automobile insurance price index. The average

premium and average expenditure are affected by

changes in insurance prices, as well as the choices

individual consumers make as to the types and

amounts of insurance purchased, whereas the

insurance price index holds the amount of

insurance constant to measure price changes in a

uniform product.

Between 2017 and 2021, the national average

expenditure for automobile insurance increased by

5.27%, while the CPI for all goods increased by

13.35%. Over the same period, the automobile

insurance component of the CPI increased by

3.95%. The basic economic law of demand explains

the difference between the change in the CPI –

Auto

Insurance

component

and

that

of

the

measured average expenditure. As the price of

insurance (as measured by the CPI) increases, the

amount of insurance demanded decreases (i.e.,

dropping coverage or increasing deductibles),

leading to a smaller increase or even a decrease in

the average expenditure.

© 2024 National Association of Insurance Commissioners

10

The national combined average premium increased

by 4.65%, and average liability premiums increased

by 3.10% over the 2017–2021 period. Premiums

charged for a particular coverage and annual

changes in those premiums vary based on the

changes in the cost of factors that impact the

coverage. Bodily injury liability premiums are

affected by medical costs, wage loss costs, litigation

costs, etc. Property damage liability and physical

damage premiums are affected by the cost of

vehicles, auto repairs, auto parts, labor, motor

vehicle theft rate, windstorms, hailstorms, etc.

Limitations on Comparability of Data

Comparisons of average expenditures and average

premiums between the states can be misleading.

The average expenditure and average premium are

imperfect measures of the relative “price” of

insurance across the states because the auto

insurance product is not homogeneous across

states. While these data reflect the average

expenditures within a state, it cannot be assumed

that the data represent equal exposure and

coverage across the states.

Policyholder preferences: A state’s average

expenditure and average premium will be relatively

higher if policyholders in that state tend to

purchase higher coverage limits or insure more

expensive cars. The type and amount of coverage

purchased by an individual is influenced by various

factors, both economic and non-economic.

Policyholders make choices about coverages, limits,

and deductibles that depend on their economic

situation, as well as their level of risk aversion, rural

or urban driving areas, local weather and traffic

conditions, and other factors.

Differences in auto insurance requirements, benefit

levels, and exposure: Some of the states have tort

automobile insurance laws, while others have “no-

fault” or “add-on” laws.

2

Some of the states do not

have a compulsory auto insurance law. Minimum

required limits for liability vary from state to state,

as well as required policy benefits. Some of the

states

have

a

much

higher

uninsured

motorist

exposure than others. The average vehicle value

differs from state to state. It is worth emphasizing

that this report reflects how much consumers, on

average, are spending for insurance, but it does not

provide information on how much insurance the

consumers are purchasing for their dollars.

Demographics: Automobile premiums tend to be

higher in urban areas. Therefore, those states with

a higher percentage of population in urban areas

will tend to have higher average premiums. In

addition, the states that gain population rapidly

tend to do so in urban areas. Because the

population increase is usually not spread evenly

over a state, the increase in average premium from

year to year can fluctuate significantly.

2

See State Laws, Page 192.

© 2024 National Association of Insurance Commissioners

11

2017-2021 State Average Expenditures and

Average Premiums for Personal Automobile Insurance Technical

Notes

Average Premium =

(Coverage written premiums)/(coverage written

exposures)

Average Expenditure =

(Total all coverages written premiums)/(liability

written exposures)

Combined Average Premium =

(Liability average premium + collision average

premium + comprehensive average premium)

Coverages Included in Liability Written

Premiums

The liability written premiums data in these

tables are for the combined voluntary and

residual market business and include (but are

not limited to) the following coverages:

•

Bodily Injury

•

Uninsured or Underinsured Motorist

Bodily Injury

•

Uninsured/Underinsured Motorist

Bodily Injury (Combined – Single

Premium)

•

Medical Payments

•

Property Damage

•

Uninsured Motorist or Underinsured

Motorist Property Damage

•

Uninsured/Underinsured Motorist

Property Damage (Combined – Single

Premium)

•

Statutory Uninsured Motorist (New

York only)

•

Bodily Injury/Property Damage Liability

– Combined Single Limit Single Premium

•

Uninsured or Underinsured Motorist

Bodily Injury and Property Damage –

Combined Single Limit Single Premium

•

Uninsured/Underinsured Motorist

Bodily Injury and Property Damage –

Combined Single Limit/Single Premium

Policies

•

Medical Expenses (Virginia only)

•

Package Automobile Policy – Indivisible

Liability Premium

•

Voluntary Uninsured/Underinsured

Motorist (New York only)

•

All Other Liability Coverages – Voluntary

Risks Only

•

Property Protection Insurance

(Michigan only)

•

Limited Property Damage Coverage

(Michigan only)

•

No Fault or Personal Injury Protection

Data Source

Written premium and written exposure data

were obtained from AAIS, ISO, ISS, NISS, the

California Department of Insurance, the Texas

Department of Insurance, MAIF and the M-CAR.

Dividends to Policyholders

The written premiums for this report do not

include adjustments for dividends to

policyholders. The actual amount paid by

policyholders with participating policies for auto

insurance will be affected by dividends paid.

Historical Data Adjustment

Written premium and exposure data are for

2021—the most up-to-date information

reported as of year-end 2022. Data for prior

years were also adjusted to reflect the most

current information for each year. Therefore,

historical averages in this report might not

match those published in prior reports.

© 2024 National Association of Insurance Commissioners

12

Miscellaneous Vehicles Not Included in

This Report

Written premium data in these tables may

differ from a state’s written premium shown in

the insurers’ filed financial annual statements.

The premium reported in the financial

statements Exhibit of Premiums and Losses

(Statutory Page 14) include data for the

following types of vehicles that are not included

in this report:

•

Motor Homes

•

Recreational Vehicles

•

Campers

•

Travel Trailers

•

Buggies

•

All-Terrain Vehicles

•

Antique Autos

•

Amphibious Autos

•

Snowmobiles

•

Golf Carts

•

Motorcycles

•

Scooters

•

Mopeds

© 2024 National Association of Insurance Commissioners

13

California

2017-2021 State Average Expenditures and Combined

Average Premiums for Personal Automobile Insurance

Additional State Information

New Jersey

The 2020 and 2021 California auto insurance data in

these tables is preliminary. The California

Department of Insurance performs a rigorous set of

tests on the data each year to ensure accuracy. The

tests are not completed until after the publication

of this report. Any adjustments to California data,

based on these tests, will appear in the next edition

of this report.

District of Columbia

The District of Columbia is entirely urban. As such,

results are not directly comparable to states with

rural areas.

Illinois

To obtain more geographically specific data, contact

the Illinois Department of Insurance.

Massachusetts

Data for Massachusetts reflects Safe Driver Plan

credits and surcharges for 2017-2021.

Maryland

Maryland Automobile Insurance Fund (MAIF) data

are included. The statutory purpose of MAIF’s

insured program is to provide auto insurance

policies to those eligible Maryland residents unable

to obtain insurance in the private market. Net

premium income and investment income from

these policies is available for the payment of claims

and MAIF’s administrative expenses. MAIF receives

no state general fund appropriations, and the debts

or obligations of MAIF are not deemed in any

manner to be a department of the state or a pledge

of its credit. MAIF is not structured as a residual

market mechanism. Instead, it is the insurer of last

resort for Maryland residents. See Section 20 of the

Insurance Article of the Maryland Ann. Code for

more details.

New Jersey is predominately urban. Results are not

directly comparable to states with large rural areas.

Historically, New Jersey has paid two to four times

the national average in dividends to policyholders,

and, at times, this has been as high as six times the

national average, which would reduce the average

expenditure and combined average premium for

New Jersey consumers if dividends were included in

premium.

Ohio

Minimum limits apply to mandatory financial

responsibility, which can be satisfied through means

other than insurance. Note policies issued or

renewed prior to December 22, 2013 had the limits

of 12.5/25/7.5. Financial Limits as of December 22,

2013 are 25/50/25.

Rhode Island

Rhode Island is predominately urban. Results are

not directly comparable to states with large rural

areas

Texas

The Texas Department of Insurance collects vehicle

and policies-in-force information at the end of each

calendar quarter for voluntary bodily injury liability,

involuntary (residual) bodily injury liability and

collision coverages. The average number of vehicles

reported for policies in force is used as an

approximation for written exposures.

Comprehensive exposures are estimated based on

the ratio of comprehensive to collision car years for

the years of 2019 to 2021. The data to estimate this

ratio only includes 70 percent of the private

passenger automobile market. That ratio is

approximately 0.99. The estimate of comprehensive

car-years affects combined average premium, but

the estimate does not affect the calculation of the

average expenditure because only liability car-years

are used for that calculation.

© 2024 National Association of Insurance Commissioners

14

2020/2021 Auto Insurance Database Report

Table 1A

Average Premiums and Expenditures 2017-2021

Liability Written Premiums

STATE 2021

2020

2019

2018

2017

Alabama 2,114,505,785

2,013,154,368

1,999,354,066

1,940,946,609

1,792,450,953

Alaska 279,770,779

274,943,211

281,024,721

273,643,422

265,497,418

Arizona 3,432,250,368

3,277,805,285

3,254,131,365

3,073,218,620

2,730,348,482

Arkansas 1,098,109,697

1,059,399,388

1,055,331,776

1,041,730,855

978,445,584

California 17,216,108,489

17,402,826,342

17,607,088,343

16,914,871,327

15,196,443,886

Colorado 3,091,341,263

3,029,021,998

3,024,356,320

2,895,845,316

2,625,248,858

Connecticut 1,902,022,952

1,836,628,884

1,796,015,030

1,868,213,649

1,728,442,258

Delaware 636,449,625

621,893,199

634,127,089

622,026,640

565,691,520

District of Columbia 209,490,802

209,120,153

211,974,142

206,529,703

189,403,247

Florida 15,512,884,520

14,186,993,723

14,154,548,923

14,069,416,038

13,240,713,993

Georgia 6,712,545,546

6,465,440,659

6,321,985,028

5,982,733,562

5,417,493,804

Hawaii 421,952,751

412,100,250

434,124,029

430,318,002

417,742,177

Idaho 589,215,922

544,722,236

528,673,569

499,087,622

457,118,128

Illinois 3,949,094,124

3,912,172,067

3,983,969,642

4,019,714,040

3,900,408,987

Indiana 2,206,832,691

2,177,385,703

2,197,849,700

2,166,475,610

2,080,772,093

Iowa 881,428,491

865,301,275

879,831,460

866,466,688

836,798,835

Kansas 997,729,704

962,932,833

989,412,296

968,572,930

911,102,153

Kentucky 2,014,415,154

2,009,733,646

2,048,151,059

2,027,132,895

1,918,758,650

Louisiana 2,936,947,120

2,915,148,622

3,017,001,548

2,974,160,945

2,755,956,953

Maine 389,695,136

374,306,853

379,075,379

372,962,507

364,067,713

Maryland 3,145,292,615

3,153,047,533

3,229,274,730

3,149,482,286

2,883,869,632

Massachusetts 2,961,044,216

2,927,198,776

3,001,945,822

2,934,073,395

2,836,967,911

Michigan 4,721,283,003

5,178,397,010

5,646,057,443

5,362,856,619

4,978,968,570

Minnesota 2,054,379,589

2,043,537,731

2,105,128,709

2,077,712,306

1,983,882,348

Mississippi 1,147,170,938

1,072,757,764

1,064,395,103

1,051,335,808

991,563,227

Missouri 2,265,169,224

2,201,618,250

2,254,559,841

2,194,037,088

2,067,940,948

Montana 393,604,122

368,695,031

363,203,204

354,923,718

335,856,669

Nebraska 686,092,721

670,599,740

686,144,401

674,052,138

649,003,253

Nevada 1,990,374,076

1,901,619,500

1,898,458,129

1,795,870,376

1,451,451,701

New Hampshire 426,812,739

414,106,949

426,309,593

415,474,060

399,850,791

New Jersey 5,255,314,628

4,967,121,845

5,351,987,950

5,280,238,431

5,021,001,142

New Mexico 884,196,732

870,672,963

883,549,418

857,277,031

799,770,032

New York 9,336,981,620

8,747,875,917

8,906,419,690

8,764,768,953

8,255,581,530

North Carolina 3,118,487,092

2,989,059,174

2,887,979,347

2,791,408,823

2,546,318,149

North Dakota 211,032,960

197,837,104

201,237,068

196,887,973

192,765,371

Ohio 3,608,516,528

3,648,610,164

3,784,565,337

3,759,333,400

3,616,304,798

Oklahoma 1,426,034,042

1,398,972,906

1,408,050,370

1,392,274,459

1,300,356,145

Oregon 1,967,176,605

1,943,553,809

1,999,564,965

1,976,470,918

1,886,857,989

Pennsylvania 4,637,002,419

4,619,088,231

4,821,545,667

4,892,624,441

4,703,480,187

Rhode Island 648,576,288

641,760,276

651,754,733

627,296,529

602,708,158

South Carolina 3,048,681,142

2,874,790,307

2,819,602,979

2,697,887,677

2,427,689,136

South Dakota 242,216,573

230,287,551

235,381,795

230,315,099

221,176,018

Tennessee 2,494,329,775

2,397,008,680

2,391,548,643

2,327,486,751

2,190,708,069

Texas 12,765,238,601

12,310,500,833

12,815,633,539

12,591,951,315

11,800,307,523

Utah 1,364,939,120

1,279,001,080

1,251,464,222

1,172,133,724

1,057,167,008

Vermont 161,202,388

160,144,434

167,214,207

167,259,043

164,622,133

Virginia 3,265,493,915

3,189,250,804

3,264,605,366

3,206,964,843

3,006,135,080

Washington 3,336,689,678

3,277,469,278

3,362,426,901

3,234,437,415

3,065,053,094

West Virginia 646,800,927

648,169,382

673,652,813

677,694,461

665,277,022

Wisconsin 1,696,833,177

1,680,892,922

1,743,047,648

1,723,610,904

1,664,529,033

Wyoming 167,634,435

160,852,062

161,697,814

159,027,865

155,034,102

Countrywide 146,667,392,807

142,715,528,701

145,256,432,932

141,951,234,829

132,295,102,461

© 2024 National Association of Insurance Commissioners

15

Table 1B

2020/2021 Auto Insurance Database Report

Average Premiums and Expenditures 2017-2021

Liability Written Exposures

STATE 2021 2020 2019 2018 2017

Alabama 4,057,070 3,891,729 3,816,921 3,785,049 3,740,733

Alaska 496,790 487,938 480,490 475,002 472,589

Arizona 5,207,064 5,067,625 4,901,386 4,740,018 4,478,934

Arkansas 2,350,073 2,265,045 2,175,091 2,138,546 2,131,968

California 28,518,512 28,171,710 28,049,675 27,679,136 26,812,052

Colorado 4,454,143 4,356,847 4,279,046 4,211,730 4,092,625

Connecticut 2,408,976 2,323,341 2,238,170 2,379,505 2,323,351

Delaware 742,860 721,549 706,727 690,849 668,333

District of Columbia 264,926 264,058 258,092 255,151 254,006

Florida 15,285,505 14,594,626 14,192,325 13,924,140 13,766,733

Georgia 8,058,078 7,808,504 7,575,069 7,460,113 7,323,364

Hawaii 938,251 914,551 906,902 898,166 890,054

Idaho 1,389,348 1,293,767 1,216,120 1,171,932 1,132,610

Illinois 7,985,647 7,803,981 7,631,068 7,770,918 7,665,718

Indiana 5,140,512 5,001,949 4,907,441 4,873,707 4,793,278

Iowa 2,568,049 2,529,700 2,508,377 2,483,819 2,466,361

Kansas 2,391,777 2,353,071 2,318,722 2,291,574 2,272,319

Kentucky 3,467,335 3,390,036 3,315,731 3,262,679 3,221,611

Louisiana 3,016,129 2,981,428 2,941,326 2,921,756 2,929,849

Maine 1,041,290 1,005,994 1,008,998 994,192 982,543

Maryland 4,382,769 4,349,177 4,307,433 4,269,280 4,159,032

Massachusetts 4,599,768 4,510,861 4,514,717 4,455,904 4,412,652

Michigan 6,007,299 5,736,779 5,754,451 5,723,448 5,686,318

Minnesota 4,263,201 4,198,707 4,190,622 4,155,989 4,101,700

Mississippi 2,076,362 1,988,143 1,950,527 1,946,859 1,933,344

Missouri 4,415,514 4,324,871 4,256,899 4,201,361 4,183,193

Montana 921,517 854,893 828,238 814,364 793,401

Nebraska 1,640,195 1,605,381 1,589,072 1,568,840 1,554,251

Nevada 2,195,129 2,116,401 2,050,474 1,991,669 1,813,685

New Hampshire 993,004 960,957 961,722 951,015 938,057

New Jersey 5,765,686 5,504,663 5,612,307 5,555,366 5,381,914

New Mexico 1,609,720 1,554,253 1,512,166 1,486,033 1,457,245

New York 9,631,016 9,459,238 9,529,484 9,524,145 9,495,527

North Carolina 7,782,727 7,554,999 7,302,920 7,079,175 6,883,016

North Dakota 703,463 651,484 644,418 637,729 633,965

Ohio 8,549,480 8,434,041 8,356,776 8,305,922 8,173,817

Oklahoma 2,944,557 2,867,079 2,776,776 2,723,443 2,578,078

Oregon 3,055,233 2,967,098 2,915,827 2,865,534 2,783,336

Pennsylvania 8,948,021 8,752,645 8,756,119 8,784,507 8,677,125

Rhode Island 700,521 704,511 709,419 698,881 692,613

South Carolina 4,169,288 4,028,672 3,923,653 3,828,054 3,743,799

South Dakota 731,658 708,067 698,354 689,115 674,707

Tennessee 5,283,095 5,087,129 4,965,034 4,864,961 4,788,190

Texas 20,351,059 20,130,323 19,711,190 19,092,535 18,694,297

Utah 2,238,927 2,114,112 2,033,545 1,947,902 1,858,075

Vermont 447,081 436,780 445,991 443,692 438,793

Virginia 6,719,837 6,643,017 6,614,567 6,497,953 6,399,907

Washington 5,000,710 4,812,496 4,755,914 4,692,003 4,593,333

West Virginia 1,322,599 1,310,283 1,301,969 1,298,868 1,295,464

Wisconsin 4,232,165 4,161,165 4,136,889 4,081,284 4,030,355

Wyoming 482,998 469,024 453,656 446,406 436,130

Countrywide

231,946,934

226,224,698

222,988,806

220,030,219

215,704,350

© 2024 National Association of Insurance Commissioners

16

2020/2021 Auto Insurance Database Report

Table 1C

Average Premiums and Expenditures 2017-2021

Liability Average Premium

STATE 2021 2020 2019 2018 2017

Alabama 521.19 517.29 523.81 512.79 479.17

Alaska 563.16 563.48 584.87 576.09 561.79

Arizona 659.15 646.81 663.92 648.36 609.60

Arkansas 467.27 467.72 485.19 487.12 458.94

California 603.68 617.74 627.71 611.11 566.78

Colorado 694.04 695.23 706.78 687.57 641.46

Connecticut 789.56 790.51 802.45 785.13 743.94

Delaware 856.76 861.89 897.27 900.38 846.42

District of Columbia 790.75 791.95 821.31 809.44 745.66

Florida 1,014.88 972.07 997.34 1,010.43 961.79

Georgia 833.02 828.00 834.58 801.96 739.75

Hawaii 449.72 450.60 478.69 479.11 469.34

Idaho 424.10 421.04 434.72 425.87 403.60

Illinois 494.52 501.30 522.07 517.28 508.81

Indiana 429.30 435.31 447.86 444.52 434.10

Iowa 343.23 342.06 350.76 348.84 339.28

Kansas 417.15 409.22 426.71 422.67 400.96

Kentucky 580.97 592.84 617.71 621.31 595.59

Louisiana 973.75 977.77 1,025.73 1,017.94 940.65

Maine 374.24 372.08 375.69 375.14 370.54

Maryland 717.65 724.98 749.70 737.71 693.40

Massachusetts 643.74 648.92 664.92 658.47 642.92

Michigan 785.92 902.67 981.16 937.00 875.61

Minnesota 481.89 486.71 502.34 499.93 483.67

Mississippi 552.49 539.58 545.70 540.02 512.87

Missouri 513.00 509.06 529.62 522.22 494.35

Montana 427.13 431.28 438.53 435.83 423.31

Nebraska 418.30 417.72 431.79 429.65 417.57

Nevada 906.72 898.52 925.86 901.69 800.28

New Hampshire 429.82 430.93 443.28 436.87 426.25

New Jersey 911.48 902.35 953.62 950.48 932.94

New Mexico 549.29 560.19 584.29 576.89 548.82

New York 969.47 924.80 934.62 920.27 869.42

North Carolina 400.69 395.64 395.46 394.31 369.94

North Dakota 299.99 303.67 312.28 308.73 304.06

Ohio 422.07 432.61 452.87 452.61 442.43

Oklahoma 484.29 487.94 507.08 511.22 504.39

Oregon 643.87 655.04 685.76 689.74 677.91

Pennsylvania 518.22 527.74 550.65 556.96 542.06

Rhode Island 925.85 910.93 918.72 897.57 870.19

South Carolina 731.22 713.58 718.62 704.77 648.46

South Dakota 331.05 325.23 337.05 334.22 327.81

Tennessee 472.13 471.19 481.68 478.42 457.52

Texas 627.25 611.54 650.17 659.52 631.22

Utah 609.64 604.98 615.41

601.74 568.96

Vermont 360.57 366.65 374.93 376.97 375.17

Virginia 485.95 480.09 493.55 493.53 469.72

Washington 667.24 681.03 707.00 689.35 667.28

West Virginia 489.04 494.68 517.41 521.76 513.54

Wisconsin 400.94 403.95 421.34 422.32 413.00

Wyoming 347.07 342.95 356.43 356.24 355.48

Countrywide

632.33

630.86

651.41

645.14

613.32

© 2024 National Association of Insurance Commissioners

17

2020/2021 Auto Insurance Database Report

Table 2A

Average Premiums and Expenditures 2017-2021

Collision Written Premiums

STATE 2021 2020 2019 2018 2017

Alabama 1,085,098,005 1,031,937,996 1,040,247,151 1,009,243,428 956,105,024

Alaska 142,717,649 134,820,264 134,554,222 127,961,940 121,338,394

Arizona 1,261,420,274 1,174,512,299 1,177,489,291 1,137,139,213 1,031,704,203

Arkansas 584,479,351 550,673,093 541,436,760 537,508,138 516,855,282

California 10,502,037,309 10,074,694,178 9,883,938,818 9,513,812,084 8,748,376,283

Colorado 1,087,714,066 1,033,378,598 1,033,635,520 1,008,194,593 972,361,583

Connecticut 789,767,421 735,104,216 763,826,505 751,446,387 717,351,374

Delaware 209,469,572 197,037,527 196,154,998 189,808,304 180,024,825

District of Columbia 119,274,519 113,459,455 111,434,352 109,413,183 102,230,664

Florida 4,256,469,155 3,877,273,509 4,085,020,926 4,063,828,992 3,805,926,890

Georgia 2,382,782,733 2,272,114,617 2,243,286,800 2,136,907,163 1,971,561,868

Hawaii 263,409,140 248,147,119 250,512,291 237,711,658 223,442,390

Idaho 279,881,905 248,900,956 237,168,498 221,581,848 198,983,387

Illinois 2,331,751,825 2,224,717,037 2,246,766,083 2,196,279,556 2,114,210,151

Indiana 1,133,664,388 1,086,637,553 1,082,941,430 1,060,157,549 1,005,160,229

Iowa 496,348,308 469,959,720 465,858,234 462,230,600 436,188,697

Kansas 460,215,705 440,125,684 447,879,261 444,294,630 424,039,958

Kentucky 681,653,952 655,856,567 685,941,253 683,746,224 648,168,748

Louisiana 1,003,956,035 974,709,812 1,022,569,458 1,019,067,341 988,714,477

Maine 240,523,766 230,323,638 227,898,860 218,164,104 206,281,636

Maryland 1,480,875,817 1,442,944,464 1,470,120,010 1,426,738,802 1,306,916,172

Massachusetts 1,763,405,025 1,740,596,123 1,729,981,783 1,677,150,517 1,601,678,947

Michigan 2,178,418,746 2,092,358,996 2,142,785,290 2,111,250,825 1,994,086,058

Minnesota 932,154,828 884,935,522 884,769,528 843,362,062 799,371,691

Mississippi 551,991,068 515,540,715 503,205,362 509,158,753 494,107,354

Missouri 1,049,791,747 992,555,283 997,986,843 972,423,567 939,416,344

Montana 182,277,251 162,505,578 155,002,247 150,513,838 141,650,589

Nebraska 323,012,625 299,916,584 295,799,235 290,401,875 274,160,173

Nevada 585,468,211 545,876,675 565,166,218 537,367,555 462,838,325

New Hampshire 300,396,498 289,437,827 295,603,991 284,213,551 272,006,992

New Jersey 1,945,459,414 1,765,644,853 1,853,734,587 1,793,442,724 1,683,337,826

New Mexico 321,180,003 307,213,707 303,828,872 294,144,207 280,521,110

New York 3,654,701,036 3,414,745,574 3,473,130,264 3,362,461,171 3,178,527,547

North Carolina 1,972,411,478 1,796,669,997 1,790,932,124 1,678,414,988 1,572,018,308

North Dakota 141,845,342 128,130,671 127,588,386 123,482,445 117,766,097

Ohio 2,032,252,606 1,979,966,032 2,017,104,232 1,978,959,744 1,911,664,108

Oklahoma 660,480,004 625,812,835 622,783,078 624,504,377 579,804,430

Oregon 637,903,030 605,732,180 619,576,172 605,146,466 555,784,441

Pennsylvania 2,679,383,750 2,587,201,867 2,650,031,202 2,607,414,510 2,496,034,686

Rhode Island 260,894,270 255,255,977 252,757,408 241,688,747 227,608,476

South Carolina 986,887,755 921,261,794 910,499,519 886,479,216 830,835,599

South Dakota 128,058,492 117,943,800 116,272,936 112,640,303 105,772,264

Tennessee 1,368,332,374 1,269,429,994 1,262,598,721 1,239,079,490 1,175,788,545

Texas 6,012,424,200 5,728,258,870 5,919,326,489 5,847,439,476 5,589,650,868

Utah 529,756,757 484,926,655 480,542,581 460,464,481 416,012,137

Vermont 125,300,218 123,090,060 124,316,113 120,771,463 115,842,506

Virginia 1,692,657,466 1,615,849,454 1,616,542,812 1,569,835,884 1,495,960,195

Washington 1,278,428,555 1,200,188,811 1,222,701,425 1,152,066,513 1,062,876,031

West Virginia 331,440,243 321,018,503 324,388,260 319,253,561 310,418,604

Wisconsin 861,915,699 820,832,274 831,569,291 804,745,844 777,216,881

Wyoming 92,334,787 88,007,948 87,067,830 86,817,263 83,209,836

Countrywide 66,374,474,373 62,898,233,461 63,526,273,520 61,840,331,153 58,221,909,203

© 2024 National Association of Insurance Commissioners

18

2020/2021 Auto Insurance Database Report

Table 2B

Average Premiums and Expenditures 2017-2021

Collision Written Exposures

STATE 2021 2020 2019 2018 2017

Alabama 2,868,909 2,735,840 2,664,753 2,636,560 2,608,895

Alaska 353,223 342,317 334,835 330,543 327,070

Arizona 3,907,459 3,759,701 3,583,931 3,478,107 3,287,389

Arkansas 1,564,382 1,504,055 1,451,565 1,432,298 1,417,964

California 20,591,618 20,080,790 19,960,100 19,664,340 19,274,539

Colorado 3,317,437 3,203,744 3,102,754 3,051,102 2,973,151

Connecticut 1,931,228 1,840,824 1,848,634 1,843,620 1,799,896

Delaware 595,597 571,303 554,202 540,122 521,687

District of Columbia 219,310 215,436 206,517 204,182 205,053

Florida 12,518,769 11,825,708 11,483,642 11,230,533 11,123,963

Georgia 5,765,407 5,504,066 5,323,497 5,223,445 5,148,370

Hawaii 709,472 684,712 676,147 664,467 652,711

Idaho 1,016,907 933,733 873,898 843,625 808,331

Illinois 6,567,952 6,392,006 6,389,821 6,470,382 6,280,848

Indiana 3,982,845 3,829,066 3,723,281 3,681,893 3,601,032

Iowa 1,929,508 1,885,989 1,855,998 1,829,730 1,783,597

Kansas 1,645,058 1,604,899 1,564,675 1,545,382 1,509,332

Kentucky 2,358,966 2,265,701 2,214,735 2,174,484 2,141,430

Louisiana 2,219,010 2,156,712 2,105,967 2,087,284 2,101,934

Maine 817,684 783,056 765,202 738,564 719,973

Maryland 3,550,084 3,480,200 3,416,172 3,381,941 3,336,288

Massachusetts 4,008,286 3,870,516 3,869,802 3,806,946 3,749,550

Michigan 4,773,514 4,508,650 4,470,786 4,405,066 4,299,429

Minnesota 3,353,422 3,284,071 3,225,064 3,171,597 3,104,568

Mississippi 1,497,176 1,420,529 1,376,364 1,362,858 1,350,116

Missouri 3,305,606 3,206,464 3,124,119 3,075,054 3,061,289

Montana 619,637 560,184 540,051 530,660 505,630

Nebraska 1,141,389 1,108,896 1,083,281 1,065,283 1,038,507

Nevada 1,642,738 1,555,963 1,508,857 1,465,589 1,339,773

New Hampshire 922,613 888,564 882,405 866,863 849,204

New Jersey 4,602,504 4,347,956 4,395,862 4,336,664 4,173,429

New Mexico 1,041,490 995,772 961,531 945,004 920,614

New York 7,668,533 7,507,601 7,390,326 7,339,041 7,272,017

North Carolina 5,686,406 5,446,059 5,204,184 4,965,973 4,783,869

North Dakota 515,777 458,533 449,131 441,065 436,560

Ohio 6,920,672 6,728,879 6,600,898 6,499,586 6,378,399

Oklahoma 1,970,433 1,897,506 1,832,879 1,797,664 1,683,076

Oregon 2,366,839 2,272,952 2,195,364 2,156,669 2,094,455

Pennsylvania 7,158,494 6,925,657 6,897,337 6,914,711 6,840,140

Rhode Island 518,512 517,682 514,781 505,272 494,286

South Carolina 3,088,757 2,952,936 2,858,895 2,783,146 2,739,303

South Dakota 499,945 479,482 468,720 459,940 446,870

Tennessee 3,900,225 3,707,591 3,565,148 3,484,492 3,417,224

Texas 14,156,200 13,915,233 13,622,867 13,199,262 12,980,190

Utah 1,724,737 1,628,710 1,557,213 1,489,598 1,414,874

Vermont 379,438 372,356 371,243 364,978 355,391

Virginia 5,236,520 5,126,511 4,990,038 4,963,502 4,888,315

Washington 4,020,375 3,822,684 3,745,045 3,684,708 3,574,122

West Virginia 958,585 936,661 918,653 911,622 897,463

Wisconsin 3,472,038 3,373,883 3,315,041 3,244,951 3,187,866

Wyoming 321,788 311,485 297,194 291,714 286,149

Countrywide 175,903,474 169,729,824 166,333,405 163,582,082 160,186,131

© 2024 National Association of Insurance Commissioners

19

2020/2021 Auto Insurance Database Report

Table 2C

Average Premiums and Expenditures 2017-2021

Collision Average Premium

STATE 2021 2020 2019 2018 2017

Alabama 378.23 377.19 390.37 382.79 366.48

Alaska 404.04 393.85 401.85 387.13 370.99

Arizona 322.82 312.40 328.55 326.94 313.84

Arkansas 373.62 366.13 373.00 375.28 364.51

California 510.02 501.71 495.18 483.81 453.88

Colorado 327.88 322.55 333.13 330.44 327.05

Connecticut 408.95 399.33 413.18 407.59 398.55

Delaware 351.70 344.89 353.94 351.42 345.08

District of Columbia 543.86 526.65 539.59 535.86 498.56

Florida 340.01 327.87 355.73 361.86 342.14

Georgia 413.29 412.81 421.39 409.10 382.95

Hawaii 371.27 362.41 370.50 357.75 342.33

Idaho 275.23 266.57 271.39 262.65 246.17

Illinois 355.02 348.05 351.62 339.44 336.61

Indiana 284.64 283.79 290.86 287.94 279.13

Iowa 257.24 249.18 251.00 252.62 244.56

Kansas 279.76 274.24 286.24 287.50 280.95

Kentucky 288.96 289.47 309.72 314.44 302.68

Louisiana 452.43 451.94 485.56 488.23 470.38

Maine 294.15 294.13 297.83 295.39 286.51

Maryland 417.14 414.62 430.34 421.87 391.73

Massachusetts 439.94 449.71 447.05 440.55 427.17

Michigan 456.36 464.08 479.29 479.28 463.80

Minnesota 277.97 269.46 274.34 265.91 257.48

Mississippi 368.69 362.92 365.60 373.60 365.97

Missouri 317.58 309.55 319.45 316.23 306.87

Montana 294.17 290.09 287.01 283.64 280.15

Nebraska 283.00 270.46 273.06 272.61 263.99

Nevada 356.40 350.83 374.57 366.66 345.46

New Hampshire 325.59 325.74 335.00 327.86 320.31

New Jersey 422.70 406.09 421.70 413.55 403.35

New Mexico 308.39 308.52 315.98 311.26 304.71

New York 476.58 454.84 469.96 458.16 437.09

North Carolina 346.86 329.90 344.13 337.98 328.61

North Dakota 275.01 279.44 284.08 279.96 269.76

Ohio 293.65 294.25 305.58 304.47 299.71

Oklahoma 335.20 329.81 339.78 347.40 344.49

Oregon 269.52 266.50 282.22 280.59 265.36

Pennsylvania 374.29 373.57 384.21 377.08 364.91

Rhode Island 503.16 493.07 491.00 478.33 460.48

South Carolina 319.51 311.98 318.48 318.52 303.30

South Dakota 256.15 245.98 248.06 244.90 236.70

Tennessee 350.83 342.39 354.15 355.60 344.08

Texas 424.72 411.65 434.51 443.01 430.63

Utah 307.15 297.74 308.59 309.12 294.03

Vermont 330.23 330.57 334.86 330.90 325.96

Virginia 323.24 315.19 323.95 316.28 306.03

Washington 317.99 313.96 326.49 312.66 297.38

West Virginia 345.76 342.73 353.11 350.20 345.88

Wisconsin 248.24 243.29 250.85 248.00 243.80

Wyoming 286.94 282.54 292.97 297.61 290.79

Countrywide 377.33 370.58 381.92 378.04 363.46

© 2024 National Association of Insurance Commissioners

20

2020/2021 Auto Insurance Database Report

Table 3A

Average Premiums and Expenditures 2017-2021

Comprehensive Written Premiums

STATE 2021 2020 2019 2018 2017

Alabama 558,969,769 525,997,170 500,642,401 481,952,938 459,336,321

Alaska 63,846,826 62,199,305 60,588,026 56,986,761 53,348,359

Arizona 895,055,907 824,789,692 788,410,124 761,826,861 706,266,022

Arkansas 400,257,115 379,483,723 361,596,542 347,830,399 315,548,199

California 2,133,299,138 2,044,712,043 2,012,139,473 1,944,387,404 1,930,026,168

Colorado 1,122,314,566 1,042,112,393 971,952,427 868,242,394 710,208,959

Connecticut 302,717,888 281,556,998 275,458,925 276,343,956 269,899,245

Delaware 88,745,340 83,399,089 79,267,600 79,094,424 72,891,492

District of Columbia 51,278,504 50,084,440 48,241,740 48,767,810 47,902,416

Florida 2,112,803,988 1,917,639,279 1,832,206,358 1,738,902,574 1,584,514,950

Georgia 1,125,059,870 1,054,770,592 1,015,746,310 969,961,617 917,892,939

Hawaii 82,106,069 78,493,880 76,886,042 76,557,325 74,463,259

Idaho 161,161,639 143,881,061 133,945,611 125,488,207 112,961,658

Illinois 1,055,728,825 998,364,670 949,494,267 926,584,882 882,080,818

Indiana 605,188,759 566,520,875 550,393,181 531,172,216 499,316,183

Iowa 484,817,844 454,980,458 431,633,964 411,651,628 393,902,660

Kansas 492,456,358 462,750,838 459,146,448 436,341,953 410,941,455

Kentucky 431,518,819 413,843,705 407,518,427 394,704,879 367,896,539

Louisiana 584,435,892 561,934,348 548,908,911 534,974,017 501,965,530

Maine 112,190,901 103,580,043 95,809,921 92,146,122 86,046,009

Maryland 626,150,120 620,283,274 605,255,731 596,818,085 567,119,058

Massachusetts 634,924,339 609,188,163 607,602,531 589,510,024 576,773,815

Michigan 947,739,681 879,265,664 834,707,411 804,462,592 769,748,449

Minnesota 814,650,655 769,780,485 748,345,941 709,101,070 664,446,824

Mississippi 385,567,943 357,771,829 339,603,570 335,247,426 318,168,986

Missouri 789,014,266 735,295,304 721,459,541 687,847,773 641,048,520

Montana 203,856,836 182,049,752 174,581,338 167,146,965 145,209,760

Nebraska 330,009,367 306,316,718 301,138,931 286,587,990 270,630,830

Nevada 200,344,244 188,341,341 186,778,203 180,731,829 159,723,998

New Hampshire 118,969,368 111,637,635 109,745,138 106,572,464 101,819,022

New Jersey 673,452,196 601,051,014 597,881,393 590,924,745 567,063,267

New Mexico 231,318,881 226,957,787 222,950,123 209,400,333 189,000,356

New York 1,561,185,617 1,444,532,421 1,401,375,772 1,446,769,845 1,394,354,563

North Carolina 981,143,055 900,521,729 827,040,076 765,167,234 652,458,616

North Dakota 133,568,837 124,451,506 124,626,936 118,330,491 109,231,216

Ohio 995,719,992 956,560,589 934,488,198 923,242,657 884,489,749

Oklahoma 551,837,944 519,893,256 506,102,785 489,662,717 436,249,500

Oregon 289,670,569 273,780,802 268,232,054 255,952,034 236,066,288

Pennsylvania 1,348,691,516 1,274,468,304 1,254,442,745 1,244,246,917 1,184,497,062

Rhode Island 86,961,518 80,788,395 76,028,601 74,501,875 70,598,179

South Carolina 721,729,815 681,534,946 647,846,009 618,057,574 579,673,792

South Dakota 191,265,470 174,525,500 168,767,019 155,515,895 142,879,184

Tennessee 732,879,417 679,178,884 640,290,902 609,355,946 575,540,597

Texas 4,079,016,427 3,810,698,004 3,812,787,201 3,563,939,165 3,116,241,955

Utah 236,022,751 216,427,686 209,071,708 200,610,085 182,502,826

Vermont 62,422,649 59,339,691 57,986,434 57,101,840 54,135,506

Virginia 846,689,029 809,883,291 799,143,128 782,493,429 754,900,436

Washington 535,207,794 504,458,639 495,438,419 472,477,728 441,922,047

West Virginia 237,111,840 229,102,843 224,563,783 222,389,375 208,566,018

Wisconsin 647,126,729 609,458,398 601,055,387 557,287,763 510,334,539

Wyoming 121,702,806 111,929,859 103,702,354 96,014,191 86,451,528

Countrywide 33,179,905,688 31,100,568,311 30,203,026,060 29,021,386,424 26,989,255,667

© 2024 National Association of Insurance Commissioners

21

2020/2021 Auto Insurance Database Report

Table 3B

Average Premiums and Expenditures 2017-2021

Comprehensive Written Exposures

STATE 2021 2020 2019 2018 2017

Alabama 2,970,204 2,837,442 2,779,027 2,741,556 2,700,864

Alaska 411,797 400,206 390,677 385,391 379,332

Arizona 4,081,576 3,947,715 3,779,239 3,655,796 3,441,026

Arkansas 1,611,110 1,549,228 1,501,936 1,477,342 1,454,340

California 21,524,794 21,021,589 20,843,945 20,518,095 20,073,955

Colorado 3,438,586 3,338,650 3,251,529 3,184,693 3,101,523

Connecticut 2,108,952 2,028,123 2,054,236 2,063,624 2,014,867

Delaware 619,793 595,328 583,066 564,800 546,165

District of Columbia 228,097 224,188 217,356 213,249 213,277

Florida 12,979,757 12,308,941 11,971,723 11,645,632 11,519,799

Georgia 6,034,432 5,776,990 5,624,804 5,493,550 5,395,029

Hawaii 765,227 733,645 723,249 710,915 695,480

Idaho 1,080,761 989,949 932,793 897,922 862,743

Illinois 6,944,949 6,799,335 6,556,572 6,585,110 6,604,144

Indiana 4,187,938 4,034,217 3,946,963 3,906,168 3,805,256

Iowa 2,010,438 1,970,242 1,946,317 1,917,879 1,857,817

Kansas 1,676,264 1,635,253 1,600,900 1,577,635 1,534,717

Kentucky 2,531,665 2,446,318 2,413,126 2,387,786 2,323,181

Louisiana 2,277,494 2,215,715 2,173,210 2,149,162 2,159,168

Maine 886,640 840,408 830,133 810,890 791,424

Maryland 3,707,829 3,636,541 3,601,868 3,562,388 3,498,644

Massachusetts 4,186,079 4,066,283 4,054,339 4,008,522 3,975,034

Michigan 5,455,413 5,205,414 5,142,963 5,052,676 4,871,188

Minnesota 3,599,437 3,551,551 3,486,494 3,432,897 3,351,226

Mississippi 1,531,142 1,454,341 1,417,767 1,398,498 1,385,006

Missouri 3,391,079 3,294,334 3,212,492 3,164,668 3,132,837

Montana 650,465 587,200 555,233 546,205 534,999

Nebraska 1,171,455 1,140,080 1,118,322 1,097,813 1,064,753

Nevada 1,693,441 1,627,752 1,566,644 1,515,821 1,382,067

New Hampshire 948,873 910,515 908,134 896,904 878,826

New Jersey 4,805,705 4,557,093 4,611,468 4,547,945 4,389,848

New Mexico 1,076,026 1,033,430 1,002,231 977,893 954,012

New York 8,265,250 8,175,892 8,104,585 8,000,344 7,770,465

North Carolina 6,047,508 5,816,551 5,540,663 5,297,308 5,121,575

North Dakota 537,372 478,554 470,353 460,225 455,340

Ohio 7,295,243 7,116,370 7,082,089 7,043,790 6,854,946

Oklahoma 2,005,412 1,939,835 1,868,361 1,824,204 1,708,287

Oregon 2,599,359 2,522,461 2,439,580 2,394,932 2,316,177

Pennsylvania 7,544,910 7,319,552 7,317,399 7,346,307 7,266,753

Rhode Island 545,331 543,362 539,279 527,959 516,874

South Carolina 3,280,109 3,144,080 3,059,866 2,979,508 2,928,842

South Dakota 514,812 494,517 485,570 474,821 458,832

Tennessee 4,123,495 3,928,520 3,803,956 3,715,247 3,633,070

Texas 14,014,638 13,636,929 13,350,410 13,200,582 13,304,694

Utah 1,806,614 1,722,313 1,643,322 1,573,115 1,488,266

Vermont 402,722 381,991 387,720 384,818 377,434

Virginia 5,592,659 5,448,688 5,345,811 5,274,222 5,163,442

Washington 4,275,518 4,175,910 4,078,264 3,996,844 3,881,351

West Virginia 1,032,136 1,010,465 995,522 988,971 976,992

Wisconsin 3,696,841 3,606,508 3,564,296 3,485,912 3,423,700

Wyoming 334,028 317,988 308,679 302,677 295,835

Countrywide 184,501,375 178,538,502 175,184,481 172,361,211 168,835,422

© 2024 National Association of Insurance Commissioners

22

2020/2021 Auto Insurance Database Report

Table 3C

Average Premiums and Expenditures 2017-2021

Comprehensive Average Premium

STATE 2021 2020 2019 2018 2017

Alabama 188.19 185.38 180.15 175.80 170.07

Alaska 155.04 155.42 155.08 147.87 140.64

Arizona 219.29 208.93 208.62 208.39 205.25

Arkansas 248.44 244.95 240.75 235.44 216.97

California 99.11 97.27 96.53 94.76 96.15

Colorado 326.39 312.14 298.92 272.63 228.99

Connecticut 143.54 138.83 134.09 133.91 133.95

Delaware 143.19 140.09 135.95 140.04 133.46

District of Columbia 224.81 223.40 221.95 228.69 224.60

Florida 162.78 155.79 153.04 149.32 137.55

Georgia 186.44 182.58 180.58 176.56 170.14

Hawaii 107.30 106.99 106.31 107.69 107.07

Idaho 149.12 145.34 143.60 139.75 130.93

Illinois 152.01 146.83 144.82 140.71 133.56

Indiana 144.51 140.43 139.45 135.98 131.22

Iowa 241.15 230.93 221.77 214.64 212.02

Kansas 293.78 282.98 286.81 276.58 267.76

Kentucky 170.45 169.17 168.88 165.30 158.36

Louisiana 256.61 253.61 252.58 248.92 232.48

Maine 126.53 123.25 115.42 113.64 108.72

Maryland 168.87 170.57 168.04 167.53 162.10

Massachusetts 151.68 149.81 149.86 147.06 145.10

Michigan 173.72 168.91 162.30 159.22 158.02

Minnesota 226.33 216.74 214.64 206.56 198.27

Mississippi 251.82 246.00 239.53 239.72 229.72

Missouri 232.67 223.20 224.58 217.35 204.62

Montana 313.40 310.03 314.43 306.02 271.42

Nebraska 281.71 268.68 269.28 261.05 254.17

Nevada 118.31 115.71 119.22 119.23 115.57

New Hampshire 125.38 122.61 120.85 118.82 115.86

New Jersey 140.14 131.89 129.65 129.93 129.18

New Mexico 214.98 219.62 222.45 214.13 198.11

New York 188.89 176.68 172.91 180.84 179.44

North Carolina 162.24 154.82 149.27 144.44 127.39

North Dakota 248.56 260.06 264.96 257.11 239.89

Ohio 136.49 134.42 131.95 131.07 129.03

Oklahoma 275.17 268.01 270.88 268.43 255.37

Oregon 111.44 108.54 109.95 106.87 101.92

Pennsylvania 178.76 174.12 171.43 169.37 163.00

Rhode Island 159.47 148.68 140.98 141.11 136.59

South Carolina 220.03 216.77 211.72 207.44 197.92